Going into debt or balancing the budget?

Two main schools of thought in economics

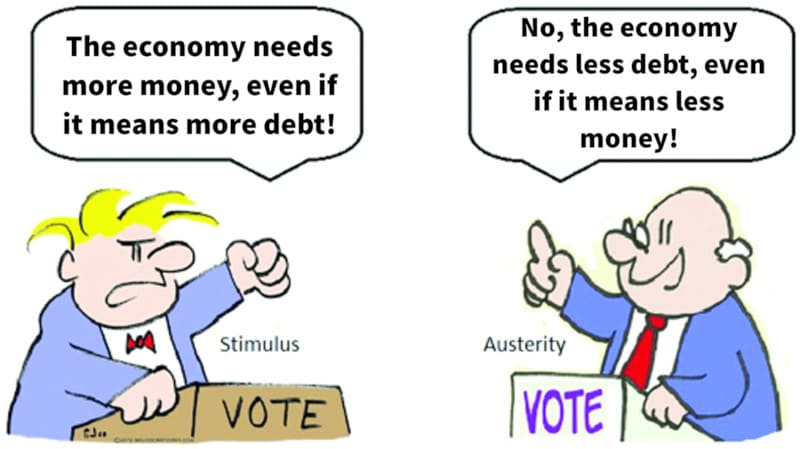

Going into debt or balancing the budget? That is the eternal question. There are two main economic schools of thought in political and academic circles today: the vision of the British economist John Maynard Keynes (1883-1946), who essentially said that the government should intervene in times of crisis to stimulate the economy, even if it meant going into debt, and what appears to be its counterpart, the vision of the economist Ludwig von Mises (1881-1973), founder of what is known as the "Austrian school of economics," who preached instead that the state should not intervene, that debts should be repaid even if it meant making cuts in the services provided by the state and helping those in need — in other words, austerity.

Justin Trudeau

Justin TrudeauTwo current examples of these two policies: in terms of Keynes's school of thought, we can cite Canadian Prime Minister Justin Trudeau who, since coming to power in 2015, has not stopped increasing spending (an 8% increase for the year 2024) and increasing deficits year after year, with a $40 billion deficit for the year 2024. In fact, Trudeau has almost doubled the country's debt since coming to power, with the Canadian government's debt now standing at $1255 billion, with $54 billion in interest to be paid on the debt for 2024.

And as for the other school of thought, that of von Mises, which says that we should avoid deficits and cut spending instead, we can cite the new president of Argentina, Javier Milei, who openly claims to follow this school of thought, and has campaigned with a chainsaw in hand, promising to make drastic cuts in state spending (up to 40%), including in aid to the most disadvantaged, blaming previous governments for having driven the country into debt. In every country in the world, it's one or the other of these situations.

Javier Milei

Javier MileiGoing into debt simply means additional taxes for the future, but as you can see from the cartoon above, even if the two discourses (debt and austerity) seem to be opposed, both are based on the same system of money created in the form of debt. If you don't go into debt, there's simply no money in circulation. It's a dead-end system: either you go into debt forever, or you starve to death trying to pay it off. For example, when Pierre Poilièvre, the Canadian leader of the Opposition, accuses Prime Minister Justin Trudeau of overspending and running huge deficits, Trudeau replies: "And you, Mr Poilièvre, if you become Prime Minister, what spending cuts will you make?"

The solution of Economic Democracy (also known as Social Credit), taught by the Scottish engineer Clifford Hugh Douglas (1879-1952), and taken up by Louis Even (1885-1974), stands above these two solutions, and is far superior to them, since it allows both the development of the country without going into debt, and also allows consumers to choose from the production offered what they need, thanks to sufficient purchasing power. More money and less debt: that's what the current financial system can't achieve, but what Economic Democracy could (see article on next page).

The solution of Economic Democracy (also known as Social Credit), taught by the Scottish engineer Clifford Hugh Douglas (1879-1952), and taken up by Louis Even (1885-1974), stands above these two solutions, and is far superior to them, since it allows both the development of the country without going into debt, and also allows consumers to choose from the production offered what they need, thanks to sufficient purchasing power. More money and less debt: that's what the current financial system can't achieve, but what Economic Democracy could (see article on next page).