www.michaeljournal.org

www.michaeljournal.org

13

Free issue of MICHAEL

by

Alain Pilote

It is very important to understand this point: the

total debt can never be paid off, for it represents

money that does not exist. Louis Even explained

it so brilliantly and simply in his fable,

The Money

Myth Exploded.

(

See page 3.

) In the fable, Oliver

lends money at a rate of 8%, but any rate – even

1% – would create an impossibility to pay back

the entire loan, principal and interest.

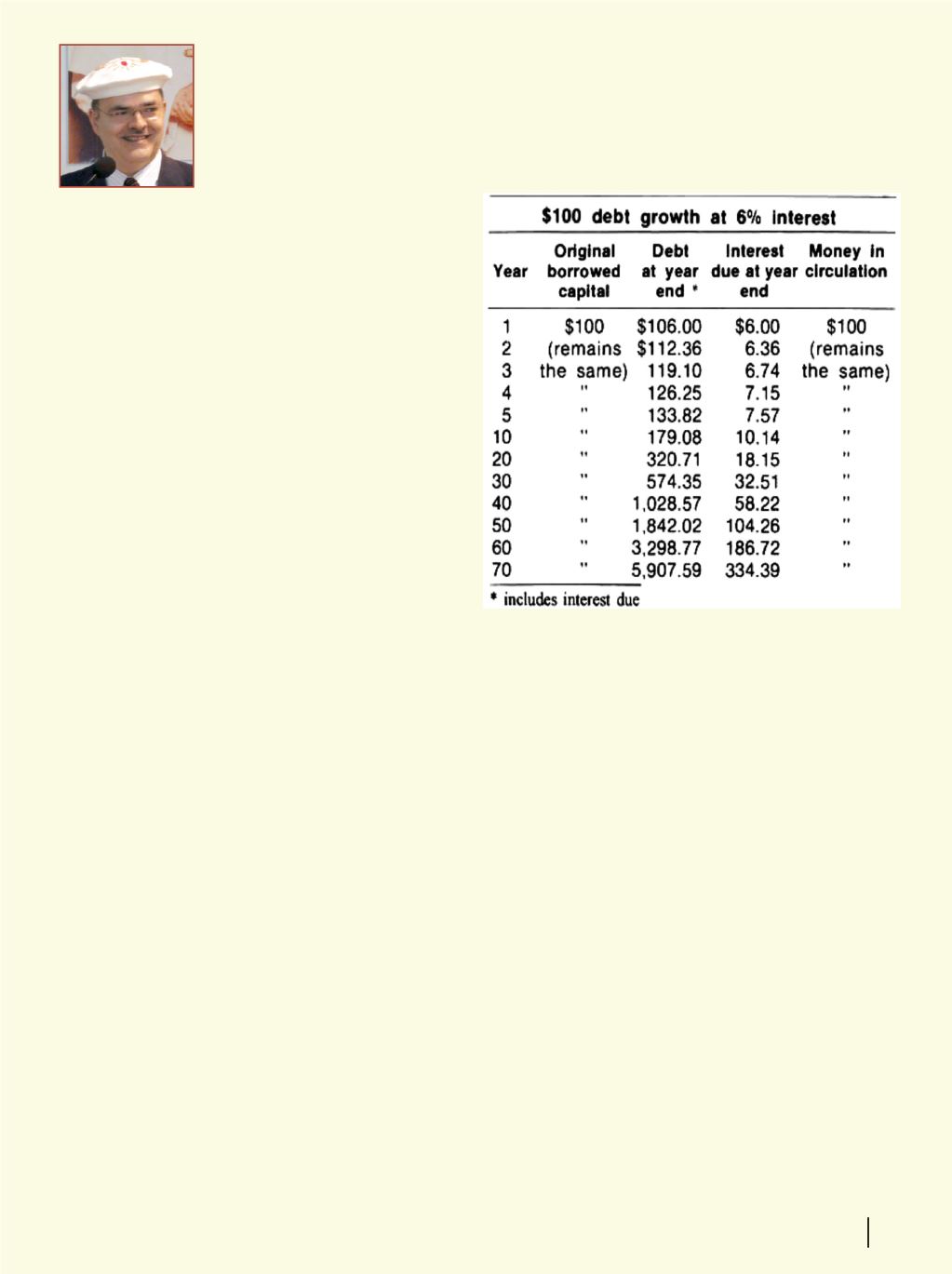

Let us suppose the five shipwrecked people on

the island decide to borrow from Oliver a total of

$100, at 6% interest. At the end of the year, they

must pay Oliver the interest of 6%, that is to say,

$6. 100 minus 6 = 94, so there is $94 left in circula-

tion on the island. But the $100 debt remains. The

$100 loan is therefore renewed for another year,

and another $6 of interest is due at the end of the

second year. 94 minus 6, leaves $88 in circulation.

If they continue to pay $6 in interest each year, by

the seventeenth year, there will be no money left

in circulation on the island, but the debt will still be

$100, and Oliver will be authorized to seize all the

properties of the island’s inhabitants.

Production has increased on the island but not

the money supply. It is not products that the banker

wants but money. The island’s inhabitants were mak-

ing products, but not money. Only the banker has the

right to create money. So, it seems that it was not

wise for our five fellows to pay the interest yearly.

Even borrowing the interest won’t solve any-

thing but will only delay the final bankruptcy. Let us

suppose that at the end of the first year, the five fel-

lows decide not to pay the interest, but to borrow

it from Oliver, thereby increasing the loan principal

to $106. “No problem,” says Oliver, “the interest on

the additional $6 is only 36 cents; it is peanuts in

comparison with the $106 loan!” So the debt at the

end of the second year is: $106 plus the interest at

6% of $106, $6.36, for a total debt of $112.36 after

two years.

At the end of the fifth year, the debt is $133.82

and the interest is $7.57. “It is not so bad,” thought

the five guys, “the interest has only increased by

$1.57 in five years. We can handle that.” However,

after 50 years, the situation is quite different. The

debt is $1,842.02 and the interest due on the debt is

$104.26.

At no time can the debt be paid off with

the money that exists in circulation, not even at the

end of the first year:

there is only $100 in circulation,

and a debt of $106 remains. And at the end of the fif-

tieth year, all the money in circulation ($100) won’t

even pay the interest due on the debt: $104.26.

All money in circulation is a loan and must be

returned to the bank, increased with interest. The

banker creates money and lends it, but he has the

borrower’s pledge to bring all this money back,

plus money not created. Only the banker can cre-

ate money: he creates the principal, but not the

interest. And he demands that we pay him back,

in addition to the principal that he created, the in-

terest that he did not create, and that nobody else

created either. (In the example mentioned above,

the banker lends $100 and wants to get $106 back.)

As it is impossible to pay back money that does

not exist, debts accrue. The public debt is made up

of money that does not exist, that is to say, the in-

terest that has never been created, but that govern-

ments nevertheless have committed themselves to

paying back. An impossible contract, represented

by the bankers as a “sacrosanct contract”, to be

abided by, even though human beings die because

of it.

Put all these results on a chart: the horizontal

line across the bottom of the chart is marked off in

years, and the vertical line is marked off in dollars.

By connecting all these points by a line, we trace a

curve, and you see the effect of compound interest

and the growth of the debt. (

See chart next page.

)

There is no way we can get out of debt

Since all money is created as a debt

u

Fr e issue of MICHAEL