To put an end to the present financial crisis, world leaders are calling for some kind of global governance, which is another word for a world government. And as "a crisis like this should not go to waste," they add that we should size this opportunity to also solve the environmental problem, that is to say, that people (especially in the Western civilization) should consume much less, in order not to deplete the earth’s limited resources. As they usually do, any crisis is a pretext for them to call for more power and centralization over the people.

To put an end to the present financial crisis, world leaders are calling for some kind of global governance, which is another word for a world government. And as "a crisis like this should not go to waste," they add that we should size this opportunity to also solve the environmental problem, that is to say, that people (especially in the Western civilization) should consume much less, in order not to deplete the earth’s limited resources. As they usually do, any crisis is a pretext for them to call for more power and centralization over the people.

But what these world leaders do not say is that we do not need a world government to solve the financial crisis, or save the environment. Besides, what they propose to get out of the crisis – spend more to create more jobs – goes exactly against protecting the environment. This is only one of the many contradictions of a flawed financial system.

If one examines the problem closely, one sees that it is the rule of the present financial system that causes such a useless degradation of the resources of the globe – especially the rule that binds the distribution of purchasing power to employment, thus creating situations like this one: ecologist groups would like to force a plant to stop polluting the environment, but the Government replies that it would cost too much and could even force it to close. So it is preferable to keep the jobs even at the expense of the environment.

Reality – the environment – is sacrificed for a symbol – money. And what about all the artificial needs created for the sole purpose of keeping people employed? What about all the paper work and red tape that requires the need for a lot of people, packed in office buildings? What about goods manufactured in order to be consumed as quickly as possible, with the goal of selling more of them? All that leads to the useless waste and destruction of the natural environment.

The basic cause of pollution in the environment and the waste of the resources of the globe is the chronic shortage of purchasing power, which is inherent in the present financial system: at any given moment the amount of money available to the community as purchasing power is never sufficient to buy back the total production made by industry.

Without this other source of income (the dividend), there should be, theoretically, a growing mountain of unsold goods. But if goods are sold all the same, it is because instead, we have a growing mountain of debt! Since people do not have enough money, retailers must encourage credit buying in order to sell their goods: buy now, pay later (or should we say more precisely, pay forever...) But this is not sufficient to fill the gap in the purchasing power.

So there is also a growing stress upon the necessity to create jobs that distribute wages without increasing the quantity of consumer goods for sale. (Note: because of progress, we have all the consumer goods we need with less and less human labour, but this is not a blessing in a system where income is only distributed to those who have a job.) So governments have recourse to what they call "infrastructure programs": they will build bridges, roads, etc. But this is not sufficient either.

The following paragraphs are taken from the summer, 1991 issue of the English publication The Social Crediter (www.douglassocialcredit.com): "Really, the only way to deal with the problems of pollution and spoliation is to remove the incentive for abuse. The principal engine of economic waste is the emphasis on production as an end in itself to deal with an inherent defect in the system of income distribution. It follows that correction of this defect would take the pressure off people to build capital that is redundant and that nobody wants in itself. It would allow a rational and balanced assessment of our environmental situation and open the broadest possible range of options for contending with it.

"The first step towards economic and environmental regeneration is to increase the flow of income to consumers. Of course, by ‘income’ is meant real buying power – not recycled debt for which the people are already responsible in their roles as consumers and taxpayers. The banks create billions of dollars daily against the real wealth produced by the population, and the upshot is that the country is wallowing in debt. These same institutions could be instructed to create credit on a debt-free basis and to equilibrate the flow of production costs and ability to liquidate them, distributing it in the form of dividends payable to all citizens.

"Against the wishes of virtually every conscious person, our beautiful earth is being intensitively ravaged and polluted and in a kind of Reichstag fire manoeuvre, power-hungry persons are using these environmental problems for self-serving political ends. When we trace the causes of the present situation to their source, we find a flawed financial system. We need not destroy the money system – indeed, to do so would be a grave error – but it is crucial that we reform it so it becomes the servant, not the master, of our aspirations."

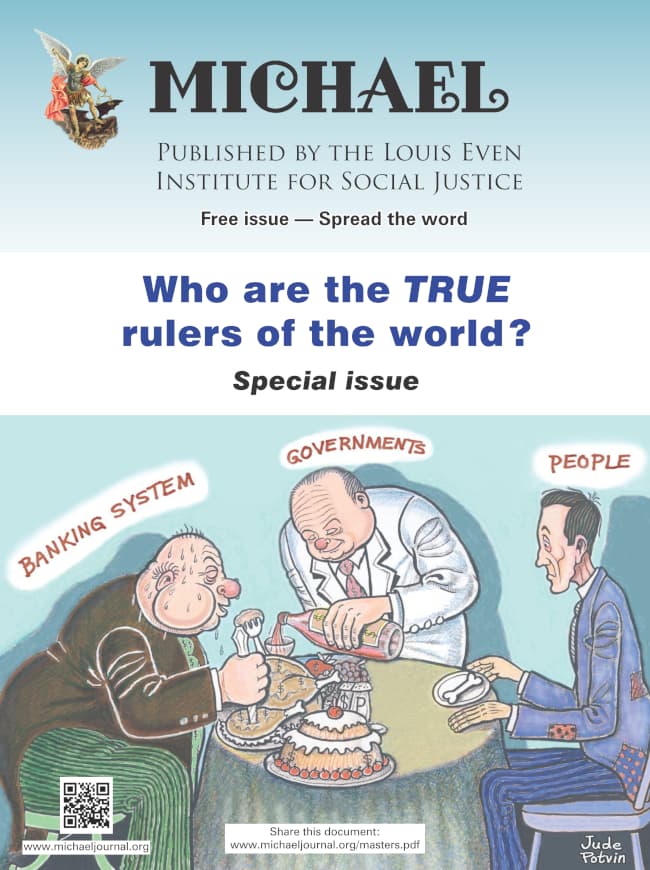

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged.

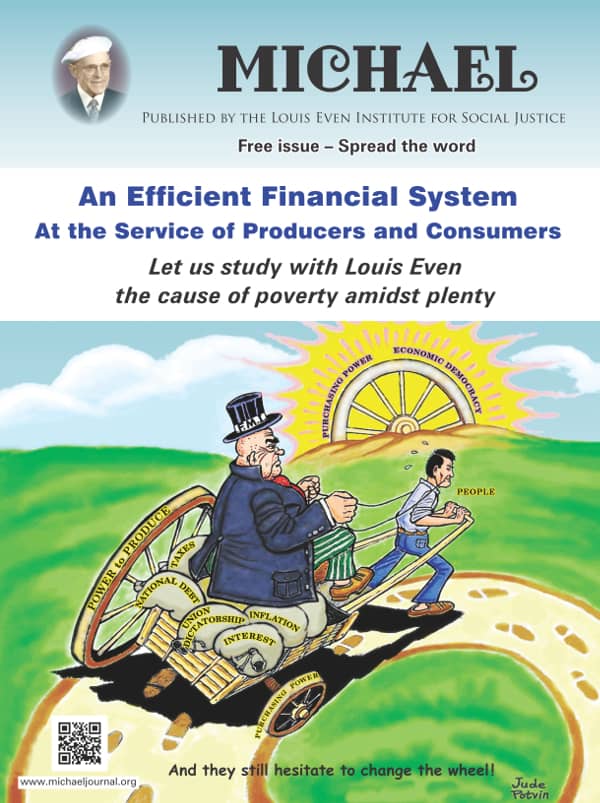

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged. An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.

An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.  Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018

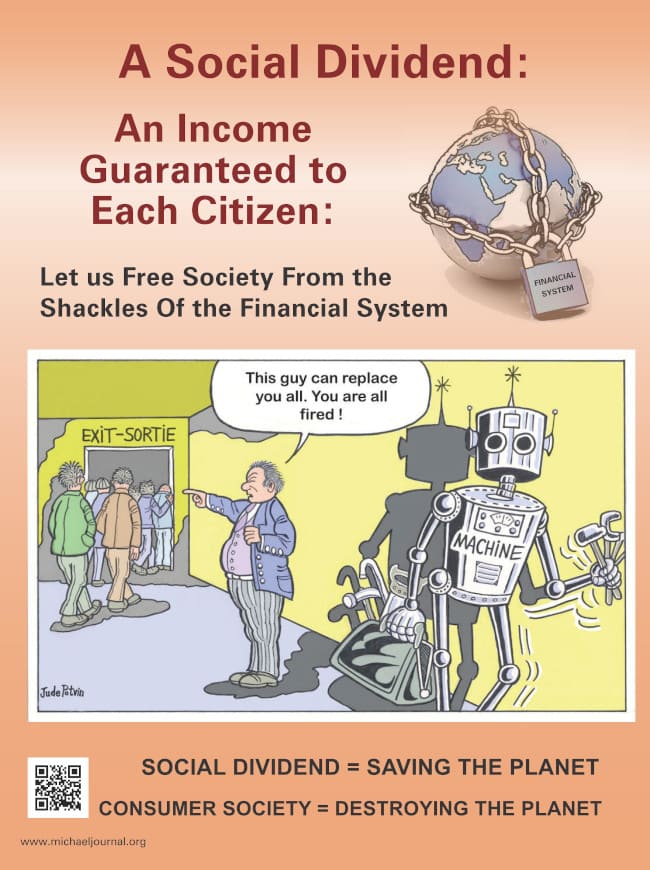

Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018 The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.

The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.Rougemont Quebec Monthly Meetings

Every 4th Sunday of every month, a monthly meeting is held in Rougemont.