It is well known that money costs nothing to create, and in the presence of a high and growing industrial capacity, the present policy of keeping the people continuously short of money is mischievous indeed. Science and invention in industry have vastly multiplied the power of production, and the need to monetise this extra capacity grows ever more urgent.

A really honest, and capable Government would do this, by way of abolishing income tax, and at the same time arrange to pay a periodic Dividend to every citizen in the country. Such Dividends to be newly created money, issued free of debt, and paid by the Treasury direct to individual citizens as a birthright, in addition to whatever other income he or she may have.

Industry would have no difficulty in meeting the extra demand this would create in the markets; prices would not rise as the new consumer dividends would not go into production costs; and wage disputes would soon die out. Failure to reverse the policy of taxation to the Social Credit policy of distributing dividends to consumers, is the root cause of the failure of present day civilization as evidenced by the atom bomb race now in progress after two world wars. Unless this issue is fairly faced up to, and the change made to Social Credit, no Government can avoid a continuance of debt dishonesty and disputes, with all the conflict and waste entailed. Because of this fact, any political election between whatever parties where the change to Social Credit is not raised as the main issue, is, in truth, an evasive sham, a diversion from reality, a fake election.

GEORGE HICKLING

Credit Notes, Oct. 1959

Taxation and high prices go hand in hand, they are complimentary. Both of them do what they are intended to do: they rob the consumer of purchasing power and prevent the emergence of any one from the dismal life-long routine of holding down a job. If income is entirely dependent on carrying out orders, people will carry out orders. If people are permitted to be financially better off, they would be in a stronger position to choose which orders they would carry out. No bank-balance, no choice. Taxation and high prices are directed to the elimination of bank balances.

There is one aspect of the situation which deserves attention. One method of raising prices is to raise wages. An extra million paid out in wages to the miners is an extra million on to the price of coal. An increase for one section is a reduction for everyone else. We take it in turns — miners, teachers, railwaymen, civil service to obtain an increase and then take our places at the back of the queue again.

Purchasing power is collected from all, merely to be alloted to some unfortunates who have been left too far behind. They are immediately called upon to subscribe for those who have now assumed the role of being the latest unfortunate. There is no room here for an increase in consumption. For this reason the raising of wages must be completely ineffective as a means of increasing purchasing power. It merely enables some to get ahead temporarily at the cost of setting everyone else back.

It follows that if purchasing power is to be increased it can only be done by an addition to incomes which will not increase prices.

It is generally assumed that this is impossible — but wait a minute. My mind keeps returning to that attention-rivetting and classic statement in the Encyclopaedia Britannica: "Banks create the means of payment out of nothing." If that is true, is it the answer to the wages-and-prices spiral?

Those who know how the banks create the means of payment out of nothing have not so far succeeded in persuading the banks to do a little conjuring on our behalf. Perhaps those people who will ultimately use their authority to direct the banks to the service of the nation, have still to learn the amazing secret. It may be described as a secret because if the millions of our people were to get to know about it they would immediately repudiate the mounting chaos in our economic affairs.

John Brummitt

in Credit Notes; Sept. 1959

If there is such a thing as "social right" it is the right to property. And nothing better illustrates the confusion of our epoch than the fact that up to now no government, no party has inscribed this device on its banner. If they think it would not be a success we believe they are profoundly mistaken.

Wilhelm Roepke, Swiss economist

Money is the life-blood of Finance, and therefore of distribution, and therefore of economics, and therefore, in any highly developed civilization, of material life itself; for without it Consumption becomes impossible and Production useless.

Maurice Colborne in, The Meaning of Social Credit.

The Montreal Gazette of October 23 carried the following despatch:

"Losses resulting from the steel strike sky-rocketed into the billions of dollars as the labor dispute hit the 100-day mark today. No permanent settlement was in sight.

"The 500,000 striking steelworkers alone — have lost $1,000,000,000 in pay. Steel industry losses are a closley guarded secret".

Who, after all, wins out in a strike of such magnitude? Not the worker. Not industry. Not the people who find themselves deprived of the products of the industry and the billion of dollars in purchasing power. Evidently the only ones who are able to reap any advantage are the leaders of the unions. They are able to pose as the champions of the workers, fighting for the latters' rights. They give to the organization, the appearance of justifying the salary they draw from the union.".

The steelworkers are paid no wages while they are on strike. Cut off the union leaders fat salaries while the strike lasts and no strike would last long enough to do the country any appreciable harm.

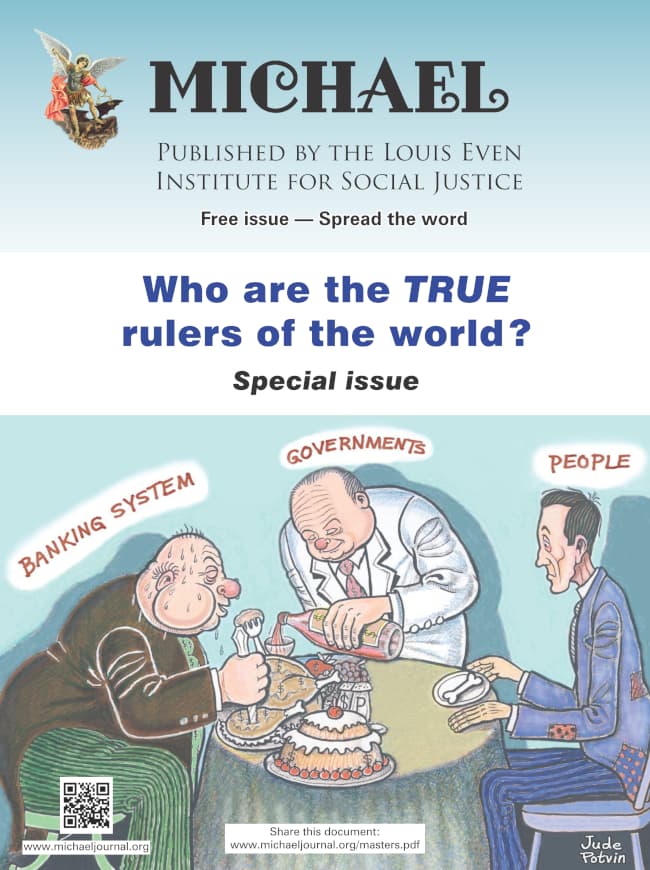

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged.

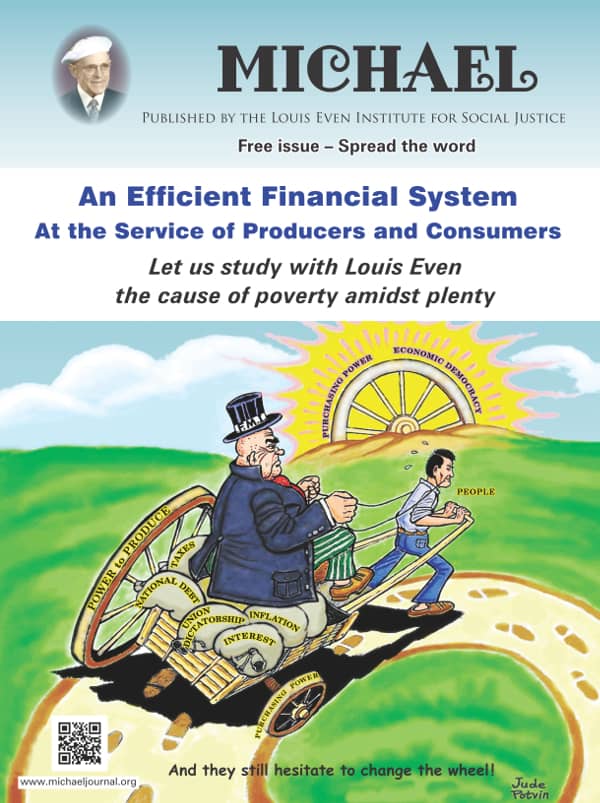

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged. An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.

An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.  Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018

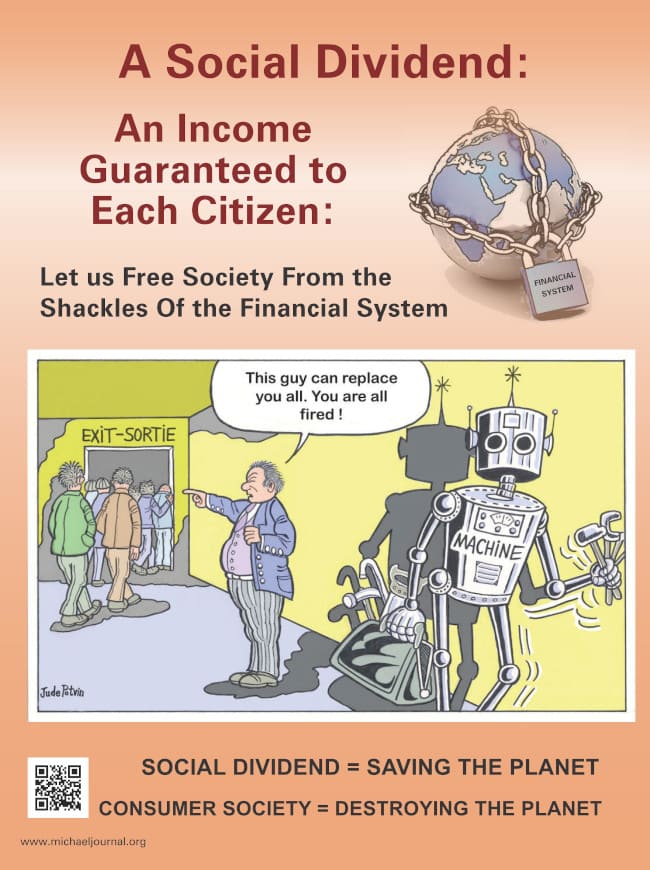

Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018 The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.

The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.Rougemont Quebec Monthly Meetings

Every 4th Sunday of every month, a monthly meeting is held in Rougemont.