The Government of Quebec announced the creation of the Department of Cybersecurity and Digital Technology in October 2021, with a budget of $4 billion and 2000 employees, led by Minister Eric Caire.

In February 2022, Mr. Caire announced his department's plan to provide all Quebec citizens with a digital identity, an 'electronic proof' to access a variety of government services, such as a birth certificate, driver's license, health insurance card, etc. According to the government, the digital identity would centralize all of one's information, thereby eliminating paperwork and duplication. Cards proving health insurance coverage etc. would become redundant as all records would exist electronically.

To access documents electronically, proof of identity is necessary. This could be accomplished by answering personal questions known only to the person, such as is now done. Even better is identity proof via biometric data, such as fingerprints and facial recognition, which are unique for each person. (Facial recognition is already used on electronic devices, including computers and cell phones.) Mr. Caire told us that facial recognition would be voluntary and not imposed for those who do not want it. Nevertheless, the technology would be installed and ready to be used in the future if needed.

The system will be implemented in Quebec by the fall of 2022, Mr. Caire said. He added that eventually, the digital identity would be used for non-governmental services such as proof of insurance, credit and debit cards, in short, everything that is attached to a person.

Moreover, in Canada and other countries, there is a plan to eliminate and replace paper money with digital currency. Mr. Neil Parmenter (right), President and CEO of the Canadian Bankers'Association, said in February, 2022:

"Canada's banks are perfectly situated to help lead the creation of a federated digital ID system between government and the private sector. The World Economic Forum agrees that banks and financial institutions should lead the path forward for digital ID."

Any technology in itself is neither good nor bad; it all depends on what is done with it. Digital money seems quite practical at first glance — doesn't a majority of the population already use bank cards, instead of paper money, to pay for their transactions? However, consider the potential abuse of an electronically maintained identity system in breaching privacy. Will our information collected by the government, and centralized in one place,, be secure? Data theft happens. In Quebec, the example comes to mind of Mouvement Desjardins; in the rest of North America, consider the Capital One security breach.

Beyond the security of our data, the greatest risk is that facial recognition and other means of biometric measurements, can easily become instruments of control and surveillance. Why fear this? We know that such a system already exists in communist China and is called "social credit". In China, social credit is a rating system which scores and rewards and punishes each citizen. (Remember that Social Credit monetary reform, developed by C. H. Douglas and advanced by Louis Even and this publication, have opposite intentions to China's population control system.)

Digital identity and facial recognition are the foundations on which the Chinese system is based. In addition to tracking each person's whereabouts, one can be refused access to every type of private and public service based on one's social credit score. What a dream tool for a dictatorship!

For example, in China each citizen is assigned a score between 350 and 950 points which changes according to their actions. Did you litter? Lose 50 points. Donate blood and earn 50 points. Report someone to the police, maybe someone who "thinks too much" or "thinks incorrectly" and gain 200 points. Are you late for an appointment or make sketchy comments on social media? Your score will be affected. If one's resulting score is too low, a citizen will be prohibited from buying train or plane tickets, renting an apartment, or even accessing a bank account.

The system works in China because of mass surveillance of the population, not only via the internet, but also augmented by the presence of hundreds of millions of surveillance cameras installed throughout the country. Every act and gesture of each of the 1.4 billion Chinese is collected in a unique and individual file.

Are you a pedestrian crossing the street at a red light? In less than three seconds a camera mounted on the street has filmed and identified you, thanks to the facial recognition system containing the faces of all Chinese citizens. In Shenzhen, for example, the faces and identities of guilty pedestrians are displayed on a giant screen until their fines are paid. China currently has 900 million of these cameras for a population of 1.4 billion.

China has sold the technology to install similar surveillance systems to 47 countries. Also very worrying is that the World Economic Forum, which strongly influences the policies of all nations, promotes this Chinese social credit system and wants its application in every country. (See the following article on the Great Reset.)

Quebec plans to be a leader in digital identity on the world stage, and Canada envisions being a world leader in implementing digital currency. This is why we surmise that Eric Caire, François Legault (Quebec's premier) and Justin Trudeau (Canada's prime minister) are obedient lackeys intent on implementing the globalists'plan. These men are repeating the talking points of the World Economic Forum (WEF) who have stated that their goal is to ensure every person on the planet is fitted with a digital ID. At the most recent WEF summit in Davos, held in May, 2022, there was also a discussion that technology is being developed to calculate each person's carbon footprint (the negative impact you have on the planet, purportedly). The purpose of such technology? To control citizens'movements by establishing fines for large carbon footprints. We can ponder whether the WEF elite will be restricted by their carbon footprint. It is more likely we will see "one law for me and one law for thee".

Digital currency will be programmable, meaning one could be restricted in their spending based on a person's social credit score, measured by technocrats and their self-serving intentions. In the next article, you will see that the Great Reset requires two components: a global digital currency and a global digital identity for every man, woman and child.

Let's be aware of what's going on and pray that God deliver us from such a technocratic dictatorship!

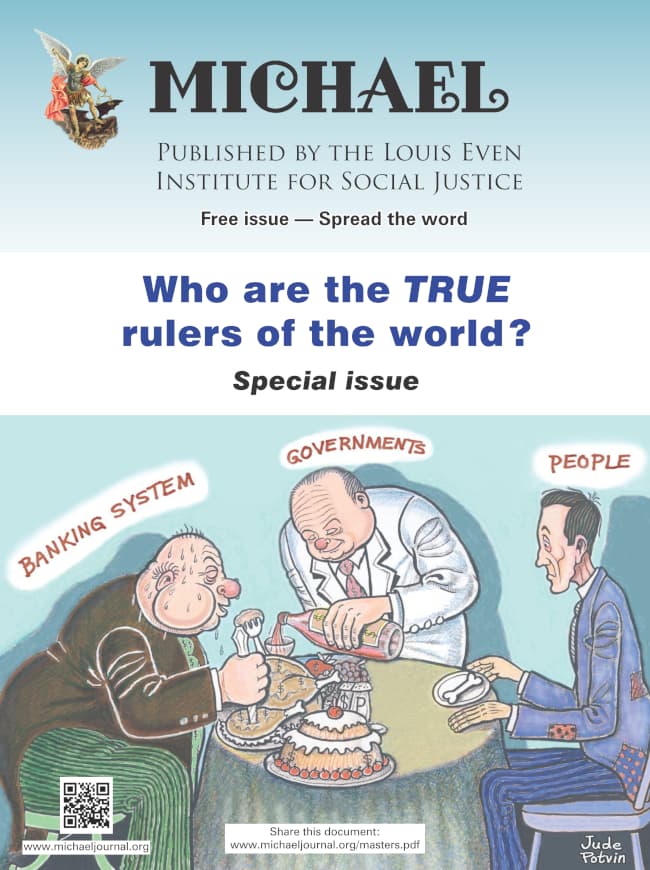

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged.

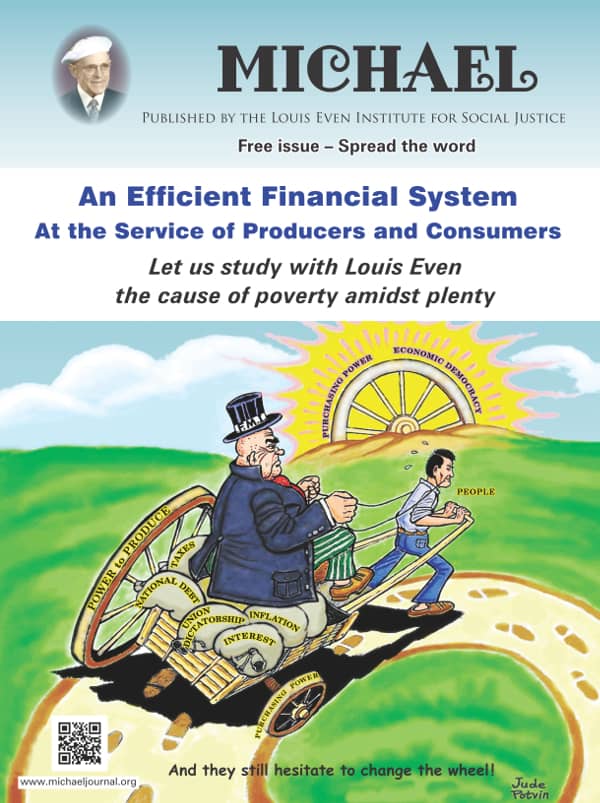

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged. An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.

An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.  Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018

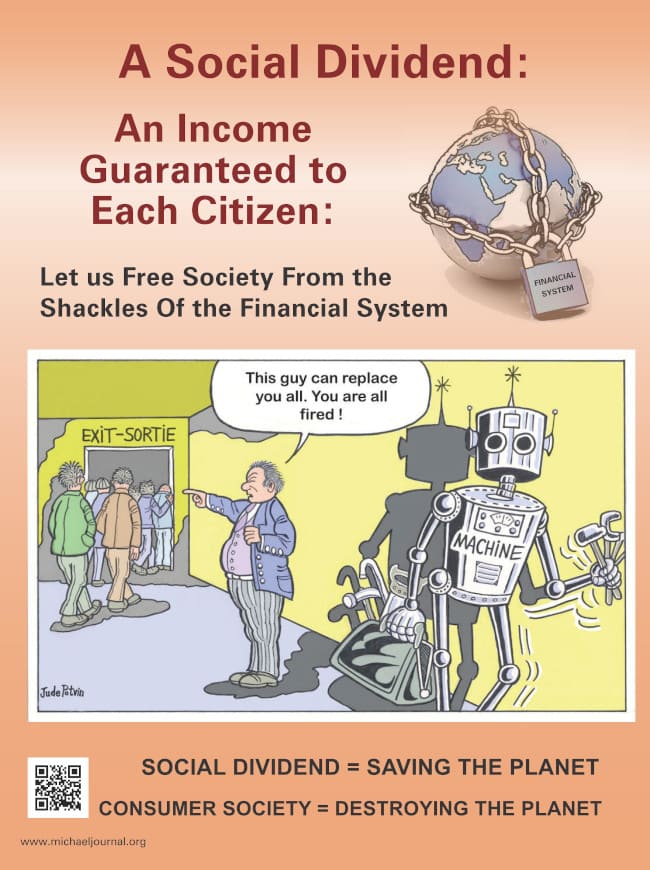

Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018 The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.

The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.Rougemont Quebec Monthly Meetings

Every 4th Sunday of every month, a monthly meeting is held in Rougemont.