The Hon. Paul Martin, Minister of Health and Welfare, speaking in the House of Commons on February 23rd, said:

"This family allowance measure... is a monument to the vision and the humanitarian qualities of the late Right Honourable W. L. Mackenzie King."

Mr. Martin said that the family allowance averages six dollars a child. This figure is the same as it was in 1945 when the measure was first introduced. But everyone knows that six dollars today buys much less than it bought in 1945. A loaf of bread ten years ago cost 10 cents; today it costs 19 cents. In 1945 a quart of milk cost 12 cents; today it costs 20. The cost-of-living has nearly doubled since 1945. So that the family allowance, actually has been reduced nearly 50 percent since 1945 in terms of purchasing power — and it is only in terms of purchasing power that money has any meaning...

Mr. King's monument, to put it mildly, is in need of repairs.

The Toronto Globe and Mail (May 23), commenting editorially upon recent remarks of Raoul Poulin (Independent M.P. from Quebec) said:

"... he (Mr. Poulin) protested that the raising of children cost hundreds of dollars more than Ottawa provided for that purpose through income tax exemptions and family allowances.

"Mr. Poulin's complaint is well founded. The Canadian Government allows a $150 income tax exemption for each child under sixteen. Such children get family allowances ranging from a maximum of $60 a year to $96 a year, making a total of $210 to $246 …

"The British Government is more honest. It allows income tax exemptions of 100-pounds per child — $280 at the current rate of exchange, but more like $560 when we bear in mind that British living costs are about half what they are here. To this, must be added the British family allowance — $60 a year to all children save the first. This figure, too, must be doubled to allow for Britain's cheaper living costs...

"The United States Government pays no family allowances. It does, however, provide a $600 income tax exemption for dependent children..."

The editorial points out that the value of family. allowance plus income tax exemption, by the week, works out to: less than $5 a child in Canada; over $11 a child in Britain; and $12 a child in the United States.

Mr. Martin argued in the House of Commons, on behalf of the Government, that family allowances should not at this time be raised and brought into line with their original purchasing power level. We note, however, that since 1945 the M.P.s of the House of Commons have twice raised their salaries — first from $4,000 to $6,000, and then from $6,000 to $10,000. They have increased their "allowances" 150 percent, and yet speak and vote against any increase in the allowances for the children of this country! Mr. Martin and his Cabinet colleagues raised their salaries much more than the $6,000 increase given to M.P.s. Consistency, thou art a jewel!

Mr. Martin admitted that he knew of no social measure which, while retaining individual freedom, brought greater benefit than family allowances.

We agree with the Minister. This allowance is, in fact, a dividend — a direct payment of purchasing power to the consumer. It benefits not only the consumer, but, by stimulating consumption, it also benefits the business man and producer.

Canada today is able to produce more than in 1945. Why, then, should family allowances be nearly 50 percent less than in 1945? A nation which can find billions for war and destruction can surely find millions for health and construction! Adequate allowances are physically possible. They must be made financially possible.

There is much political talk about the Government instituting national health insurance schemes and socialized medical services. A substantial increase in family allowances would permit Canadian families to pay their own bills and look after their own health and medical needs, without any costly socialistic schemes which inevitably build up a parasitic bureaucracy and restrict individual liberty and freedom.

The monument can be repaired, Mr. Martin.

Down with socialistic health schemes, and up with family allowances. With purchasing power in their pockets, our citizens need no government to look after their needs.

Dividends, not socialism, lead to Freedom and Abundance.

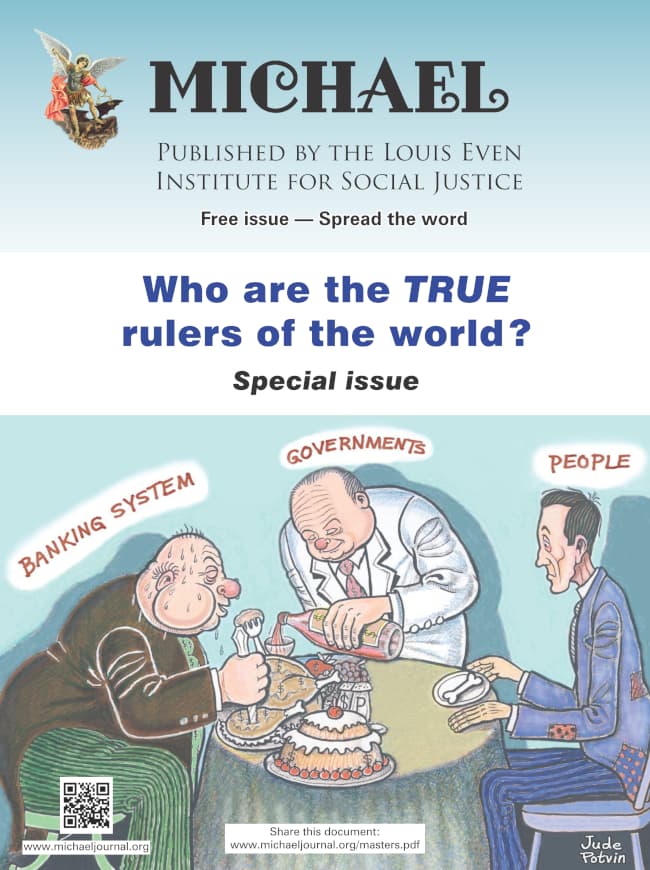

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged.

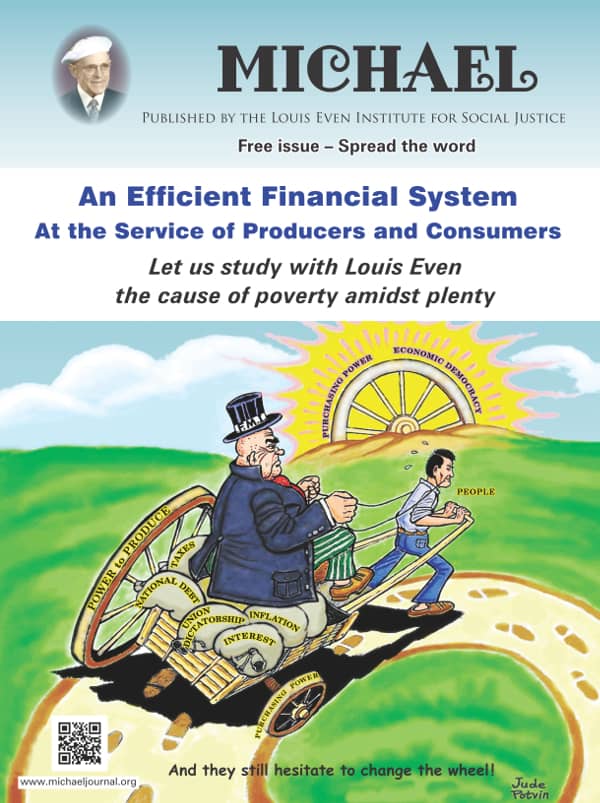

In this special issue of the journal, MICHAEL, the reader will discover who are the true rulers of the world. We discuss that the current monetary system is a mechanism to control populations. The reader will come to understand that "crises" are created and that when governments attempt to get out of the grip of financial tyranny wars are waged. An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.

An Efficient Financial System, written by Louis Even, is for the reader who has some understanding of the Douglas Social Credit monetary reform principles. Technical aspects and applications are discussed in short chapters dedicated to the three propositions, how equilibrium between prices and purchasing power can be achieved, the financing of private and public production, how a Social Dividend would be financed, and, finally, what would become of taxes under a Douglas Social Credit economy. Study this publication to better grasp the practical application of Douglas' work.  Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018

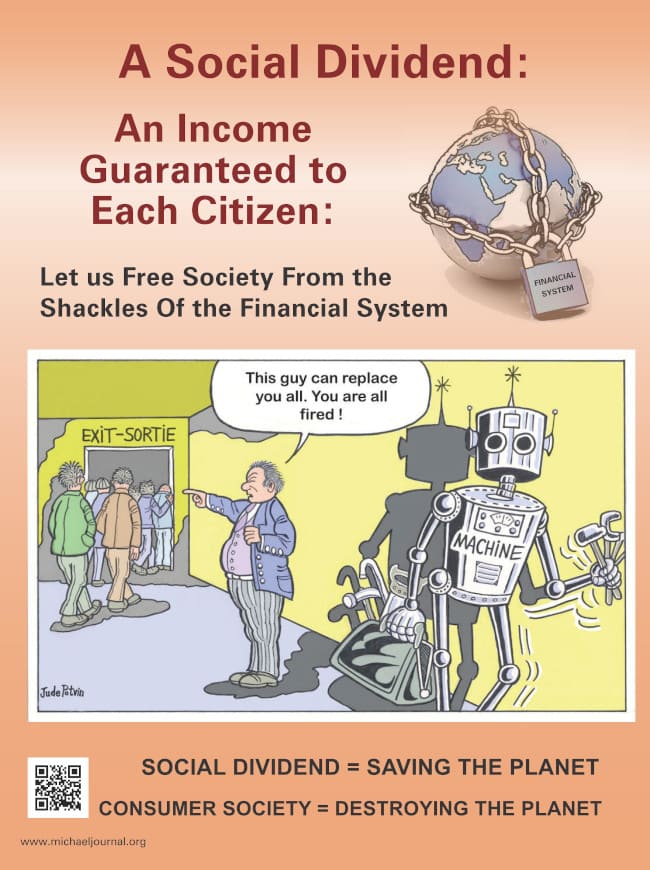

Reflections of African bishops and priests after our weeks of study in Rougemont, Canada, on Economic Democracy, 2008-2018 The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.

The Social Dividend is one of three principles that comprise the Social Credit monetary reform which is the topic of this booklet. The Social Dividend is an income granted to each citizen from cradle to grave, with- out condition, regardless of employment status.Rougemont Quebec Monthly Meetings

Every 4th Sunday of every month, a monthly meeting is held in Rougemont.