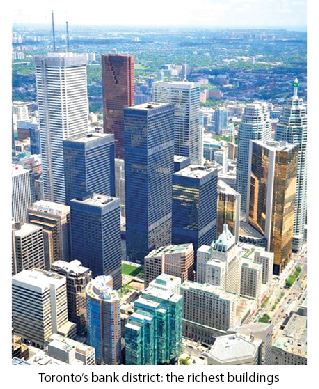

Did you ever wonder why the most beautiful buildings of a large city are always its banks? The answer: it actually cost them nothing, they are simply honoring their own cheques! Here is how Colin Barclay-Smith explains it in his book:

We have stated that most money comes into circulation as a debt to the banks. We say “most” of it does, The only money that does not originate as a debt to the banks is the money banks use in their own purchases. All money that a bank spends on its own behalf, whether it is the payment of its employees’ salaries, the purchase of a building site, a building, stocks and shares, printing, advertising, stationery, etc., all such purchases put money into circulation debt free.

Let us deal with the statement that banks purchase properties or securities by the simple process of honouring their own cheques. Take the case of a property or bank premises. First, the bank draws a cheque upon itself. This cheque is paid into someone’s else account — probably at another bank. Thus bank deposits are increased.

To offset this purchase in the bank’s balance sheet, there would be an increase in the bank’s assets, i.e., Premises Account. The accounting technique is to debit Premises Account with the amount of the purchase and credit the same amount with the value of the asset.

To offset this purchase in the bank’s balance sheet, there would be an increase in the bank’s assets, i.e., Premises Account. The accounting technique is to debit Premises Account with the amount of the purchase and credit the same amount with the value of the asset.

In a similar manner, a bank can purchase shares or Government securities. These would be paid for by a cheque drawn on the bank and in due course the amount of the cheque and purchase are placed to the debit and credit of Securities Account.

It may be argued, of course, that a bank pays for its properties and securities out of profits or reserves. But this idea is as illusory as the fiction that a bank lends its deposits. Neither profits nor reserves are affected by any purchase by a bank, because it hasn’t actually parted with anything,

The position is very different when an individual buys a premises. The cost of the purchase is debited to his bank account. The individual, though he has acquired an asset, is down in his balance at his bank to the extent of the transaction. But in the case of the bank’s purchase of a premises or securities, or indeed anything else, the cost is no more than a book entry in its own books.

As Hawtrey, one-time under-Secretary to the British Treasury, observed in his Art of Central Banking: “Other lenders have not this mystic power of creating the means of payment out of nothing.”

You may object that if bank “A” bought a premises and its cheque in payment was deposited with bank “B”, the latter might not co-operate. That is a possibility, of course. But this is met by an exchange of balances with other banks. If the banks work in harmony with each other (as they do), they can meet their own requirements and acquire assets, at no real cost to themselves.

The foregoing may explain to the reader why the banks have been enabled to acquire the most valuable building sites in cities and towns and erect such remarkably attractive premises. Most of the main city banks are beautified with marble from floor to ceiling, and the humble depositor feels like doffling his hat, and standing in silent awe and admiration in such an atmosphere of hallowed opulence and power. Now we know the secret of it.

Colin Barclay-Smith