The following article was first published in 1939. Much of the information found within is borrowed from Gertrude Coogan’s book, “Money Creators,” published in 1935. Ms. Coogan died mysteriously at age 29, shortly after her book was published.

The current banking system is pure robbery: Anyone who cares to study the matter (the creation of money and credit, as debt, by the banks, and their absolute control over this medium of exchange) can only agree. But it is legalized robbery, that is to say, banks act within the “legal” limits of their charter, while running a racket for the benefit of a small clique of individuals who thrive on the people’s backs. This charter is a licence to bleed and to kill granted by sovereign governments.

From the Renaissance on, parasites can be found who dealt in loans and who, through usury, would lay their hands on the money being circulated in the countries where they had set up shop. The safekeepers of gold quickly learned to take advantage of the credulity of an ignorant people and to lend them what they did not have to begin with. Gold remained in the goldsmiths’ vaults; the receipts of the individuals who entrusted their gold to the bankers and the bankers’ promisory notes circulated alongside gold itself, and brought in the same profits.

But it was in 1694 that the bankers legally obtained the right to manufacture and lend money at interest to the sovereign government as well as to individuals. That year, King William III of England needed money to wage war. Since the revolution of 1688, there existed in London, a company of rich men who called themselves the “Company of the Bank of England”.

We quote the following from The Breakdown of Money, by Christopher Hollis:

“In 1694 the Government of William III was in sore straits for money. A company of rich men under the leadership of one William Paterson offered to lend William £1,200,000 at 8 per cent on the condition that the Governor and Company of the Bank of England, as they called themselves, should have the right to issue notes to the full extent of its capital.”

That is to say, the Bank obtained the right to collect £1,200,000 in gold and silver and to turn it into £2,400,000, lending £1,200,000, the gold and silver, to the Government, while using the other £1,200,000, i.e. the bank-notes, to lend them to commerce and industry at a profit to themselves.

Paterson understood fully the important privilege that was bestowed upon them. The owners of the Bank could circulate their own funds of twelve hundred thousand pounds without having more than two or three hundred thousand pounds in reserve. It was as though the Bank had lent £900 000 or £1 200 000 pounds to the nation. In practice they did not need to keep a 25%o cash reserve. By 1696, they had £1,750,000 worth of notes in circulation against a cash reserve of £36,000, a cash reserve that barely exceeded 2%.

Thus, a private bank became more powerful than the king. From the beginning of this takeover of public affairs by a group of exploiters, we find this new monetary machine being used primarily to finance wars; it is at such times that are laid the bases for huge everlasting profits. This machine had lost none of its adaptability in 1914: not a single government ran out of money to drive its citizens to the great bloodshed that took place in World War I. The phrase “No money”, often repeated today, was not heard once from 1914 to 1918.

International Finance, the mother of all banks, strengthened its hold each time it generously placed its fertile pen at the service of governments who became the signatories of obligations. Through progress, money has dematerialized and it no longer needs to be printed.

The international House of Rothschild is a fine example of a fortune built upon human massacres. In her book, Money Creators, Gerture Coogan explains: “Meyer Amschel Rothschild entered the scene. His family of five sons and five daughters had taken the name of Rothschild from the Red Shield which hung in front of Meyer’ s shop in Frankfort-on-the-Main in Germany as his trade-mark. Meyer conceived the idea of enlisting young men as mercenary troops, painting to them the glories of military service, etc.

“When King George III of England was unable to secure British soldiers to fight their cousins across the Atlantic, he went to the Landgrave of Hesse Cassel, at Hanau, near Frankfort. George III paid $20,000,000 to the Landgrave for some 16,800 Hessian mercenaries ($1,200 per head) who had been organized and trained by Meyer Amschel. The Landgrave loaned this $20,000,000 to Meyer Amschel at a very low rate of interest for ten years.

“It is well known that the foreign borrowing of funds for the American Revolution was accomplished through the efforts of Robert Morris. It is not so well known that Morris secured his funds from Haym Solamon. Those who know anything of international banker solidarity will appreciate immediately that Meyer Amschel loaned the money to Solamon, which was in turn loaned through Robert Morris to the American Colonies. Thus, George III paid for the American Revolution and the international financiers played both ends against the middle; no matter who lost, they won, and lives were sacrificed on both sides.”

Meyer Anselm Rothschild raised his five sons to continue this successful business. The ablest of them, Nathan, moved to London, where he established the bank and brokerage house N.M. Rothschild and Sons; James moved to Paris, Solomon to Vienna, during the French Revolution. Napoleon’s wars were timely. England borrowed from Nathan Rothschild to fight Napoleon. Napoleon borrowed from James Rothschild and his associates to fight England. Soldiers fell, wives and mothers cried, conflicts intensified while the Rothschilds profited...

Nathan, who was a true financial genius, won six million dollars in a single day, two days after the famous battle of Waterloo which led to the downfall of Napoleon. Nathan also intervened in Spain, in 1835, in retaliation against a government that refused to do his will eventhough he had paid off Spain’s Minister of Finance. Nathan and his brother in Paris spent nine million dollars to ruin the Spanish Securities, triggering a global crisis that ruined thousands of bond holders, while the Rothschilds grew richer on the ruins. In Vienna, his brother wrote a confident: “Tell Prince Metternich that the House of Rothschild acted thus, through vengeance.”

The same technique continues to be used by international bankers today to rob their victims. Austria was dismembered after the Great War and the Rothschild brother of Vienna was left in poor financial shape. But not for long. Eight years later, when French President Poincaré prepared a law to stabilize the franc, in collaboration with the Bank of France, James — the Rothschild of Paris, director of the Bank of France (a private bank), was able to warn his cousin in Vienna. The latter hastened to buy francs, then on a downward trend, and sell them once their value had increased following the adoption of the Bill by the French parliament. In less than a week he had rebuilt his entire fortune... on the backs of the French people!

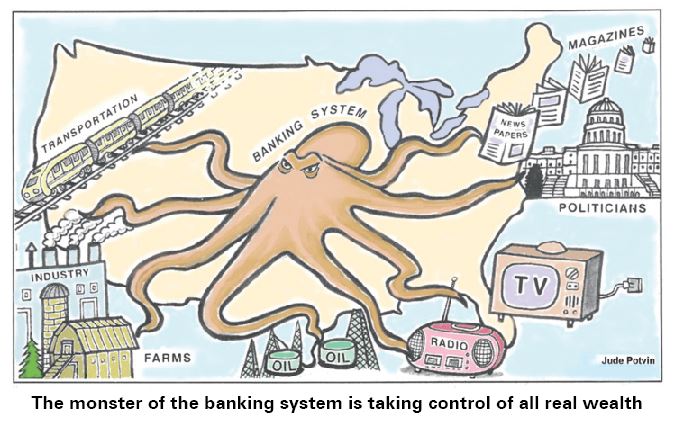

International finance knows no homeland. It is involved in all things, it is everywhere, it extends its tentacles to all countries. It causes countless ruins and answers to no one. In 1931, Pope Pius XI mentions “a no less deadly and accursed internationalism of finance or international imperialism whose country is where profit is.” (Quadragessimo Anno, no 109)

American colonists revolted against England in 1776 because of the London financiers’ greed that took away from the colonies the right to make their own currencies, leaving them at the mercy of the exploiters in London. This explains why the Founding Fathers were careful to state clearly in the Constitution that “Congress alone shall have the power to coin money, and regulate the value thereof.” (Article I, Section 8, Par. 5). The American people won the war of independance against England. Their constitution remains. But the U.S. Congress neither creates nor issues the country’s money. Nor does it regulate its value.

How can this be? Even though the English government lost its war, the international financiers won theirs and continued exploiting America as though it were a colony of international finance. America was not a prey to let go of since it already showed the signs of a continent that was destined to great wealth.

Alexander Hamilton

Alexander HamiltonIn all of their major attempts to draw countries into their nets, the masters of finance operate through hitherto unsuspected intermediaries who are given a polished reputation owing to the influence they exert on the media. At the origin of the American Republic, stood the man of the hour: Alexander Hamilton.

Hamilton was born in the West Indies. From a very young age, he was fascinated by anything that had to do with figures, finance and money. At the age of 13, he went to work for Henry Cruger, the largest merchant in the Caribbean. At the age of 17, he left for New York, where he lived until his death in a duel against his business and political rival, Aaron Burr, in 1804.

Hamilton took part in the War of Independence and was for some time secretary to the General in chief, George Washington. In his spare time, he would study at length, currency, the minting of money, and the topics of gold, silver and international monetary trade. He adhered to a philosophy whereby mankind must be subjected to a handful of individuals. He championed the idea of a system where a privately-owned central bank would be endowed with sovereign privileges, as was the case with the Bank of England.

During the war of independence, the colonies in revolt issued their own debt-free currency. The European financiers, who then ruled over the creation and lending of debt-money, could not tolerate such an affront. They caused the value of the U.S. currency to fall by flooding the colonies with counterfeit bills. This power, held in private hands, struck Hamilton and encouraged him to pursue his studies and his research; he wanted to know how individuals could possibly exercise such power, not for the purpose of defeating them, but so as to imitate them.

His belief in a central bank that would, in colaboration with financial powers, control a nation’s money, increased as he became aware of how easy it would be to put it over an uninformed public.

During the war, Hamilton began to plan the implementation of this same inequity to America. On April 30, 1781, twenty-year-old Hamilton, who had gained ascendancy over Robert Morris, the Secretary of the Treasury for President Washington dared write to Morris: “A national debt, if it is not excessive, will be a national blessing; a powerful cement of union; a necessity for keeping up taxation, and a spur to industry.”

1789: The American Constitution is adopted and the first President, George Washington, forms his first cabinet. He offers the Treasury to Morris. Much to his surprise, Morris refuses and recommends Hamilton. Washington then commits the biggest mistake of his administration, one that will compromise all of his work. Hamilton becomes the first secretary of the U.S. Treasury (Minister of Finance).

Benjamin Franklin dies in 1790. Hamilton is now free to implement the plan he has been dreaming of. But he must bypass the U.S. Constitution which clearly states that Congress alone has the authority to coin and to issue money. Franklin is gone, but Jefferson remains and no doubt watches over the great work in which he took such a large part.

The debt of the United States was contracted mainly for war. It totaled $ 75 million at the time, which was owed partly to foreign interests and partly to American individuals who had purchased bonds that the Rothschilds of Frankfort had issued, as explained above. Money was needed for the new nation to carry out its business. The United States were a sovereign state. Would it not have been wiser to issue the currency it needed, in metal or paper form, and to put it into circulation? Hamilton thought otherwise. He insisted that the debt be converted into interest-bearing bonds. Rather than creating debt-free currency and placing it into circulation (an average of $19 per capita), he chose to create a national debt that amounted to $ 19 per person.

As Secretary of the Treasury, Hamilton was held to secrecy. This did not keep him from reaching out to the more influential members of Congress, to invite them to take part in his scheme. Knowing that the government’s certificates would be transformed into interest-bearing bonds guaranteed by the State, many congressmen hastened to buy as many certificates as they could, at the lowest price possible, from their constituents, before they were to be turned into bonds. Under the influence of corruption, the leading congressmen were led to agree to the consolidation of the debt as presented by Hamilton.

Jefferson resisted and denounced the “prostitution of laws which constitute the pillars of our whole system of jurisprudence.” The farming class gave Jefferson its support. But communications were slow at the time, and Hamilton’s debt-based philosophy was imposed upon the young nation.

There remained to establish a private central bank, to create and to lend money, the way the Bank of England did. Hamilton undertook this, in 1871. He encountered little opposition from the Senate that housed the representatives of the financial powers, the same way as our Canadian Senate does today. But he had to face Jefferson, Madison, Adams and others. Over time, he acquired the art to fool and to stall. He dressed his arguments with virtue: “The emitting of paper money by the authority of government is wisely prohibited to the individual states by the national constitution; and the spirit of that prohibition ought not to be disregarded by the government of the United States. The wisdom of the government will be shown in never trusting itself with the use of so dangerous and seductive an expedient.”

Hamilton would rather see this “dangerous and seductive expedient” placed in the hands of a small group of individuals who would have every privilege but none of the responsibilty that accrues from an electoral mandate. The Constitution is written with precision, but Hamilton, through his cunning and skill, invents and stresses the idea that the Constitution implies other nonexpressed powers.

When Congress took a vote on the private central bank issue, Georges Washington asked Madison to prepare a veto. But he would eventually give in to Hamilton’s persuasive eloquence. The «financial expert» had won. The New York Chamber of Commerce gave Hamilton a special reception to celebrate the victory of finance over the nation.

Abraham Lincoln, a honest man

Abraham Lincoln, a honest manInternational finance took possession of America as it had Europe. It worked to ensure that its position be maintained and consolidated. A man stood up, one day, who dared to deal it a remarkable blow. His name was Abraham Lincoln, the greatest of all American presidents. It costed him his life...

A farmer’s son who never had the opportunity to attend school, after having learned to read on his mother’s knees and having studied law at night after his day’s work in the woods or on the farm, Lincoln came to the Presidency of the United States at a critical time, the Secession of the South from the Union over the issue of slavery.

Gifted with a robust common sense and guided by perfect righteousness, Lincoln thought that if private banks can create money and have it accepted by the public, only in the form of debt, the sovereign government can just as well create it and confer upon it the same legality. He therefore asked his Secretary of the Treasury, Salmon P. Chase, to make three successive issues of government notes, for a total of $ 450 million, in 1862 and 1863.

These notes were called greenbacks. Let us note that after a legal battle between the financial powers and the government, $346 million have remained in circulation and are just as legal as any bank note. But better still, unlike the banks’ debt money, the greenbacks did not add a single dollar to the public debt of the United States. If this money had been issued through the ordinary channel of commercial banks, it would have meant adding an extra ten billion dollars to the US public debt, from 1863 to 1938 (through compound interests).

If all U.S. money was issued by government, the United States would have no public debt. The same can be said of all countries. The existence of public debts indicates that the present financial system is flawed, that money is tainted from its inception.

The international bankers fully understood the impact of Lincoln’s actions as shown by the following text published in the March, 1863 issue of the London Times:

“If that mischievous financial policy, which had its origin in the North American Republic during the late war in that country, should become indurated down to a fixture, then that Government will furnish its own money without cost. It will pay off its debts and be without a debt. It will have all the money necessary to carry on its commerce. It will become prosperous beyond precedent in the history of the civilized governments of the world. The brains and the wealth of all countries will go to North America. That government must be destroyed or it will destroy every monarchy on the globe.”

And the advice was followed. A conspiracy was hatched by ternational finance: The bullet of a feeble minded brought down the great emancipator. Let us be reminded, by the testimony given by the opressors of mankind, that the prosperity of countries will stem from from a policy whereby each government would issue, free of debt, all of the money the people need to carry out their business.

“The death of Lincoln was a disaster for Christendom, wrote German leader Bismarck. There was no man in the United States great enough to wear his boots. The money lenders went on to grab the riches of the world. I fear that foreign bankers with their craftiness and tortuous tricks will entirely control the exuberant riches of America, and use it to systematically corrupt modem civilization. They will not hesitate to plunge the whole of Christendom into wars and chaos in order that the earth should become their inheritance.”

For a long time, gold and silver were both used for coinage. In 1818, England demonetized silver. Since it had the control of gold, but other countries had silver mines, its financiers did all they could to demonetize silver everywhere and establish gold as the only standard. In 1873, they set their aim on American currency. We are often told that gold is, by tradition, the only real currency. From 1789 to 1873 the two metals enjoyed the same prestige in the United States. The gold standard was only established in 1900. (Ed. Note: It was later abolished by President Nixon in 1971.)

Ernest Seyd, an agent of High Finance

Ernest Seyd, an agent of High FinanceLet us now introduce another figure, one who did not fall under the bullet of an assassin. He was the kind of lackey whom the London financial circles delegate to our continent under the guise of financial expertise, each time some chains are to be forged.

Ernest Seyd was the agent of international finance in getting the United States to pass a law to demonetize silver thus placing America further under the rule of the world financial powers. Seyd was an advisor to the Bank of England, or so he said. Let him relate what he succeeded in doing in 1873:

“I went to America in the winter of 1872-73, authorized to secure, if I could, a bill demonetizing silver. It was to the interest of those I represented — the governors of the Bank of England — to have it done. I took with me £100,000 sterling, with instructions that if it was not sufficient to accomplish the object to draw for another £100,000, or as much more as was necessary. German bankers were also interested in having the bill passed. I saw the committee of the House and Senate and paid the money and stayed in America until I knew the measure was safe.”

The law was signed by President Grant in the early part of 1873. He would admit, eight months later, that he did not understand the text he had signed into law. Several Congressmen would later write similar statements confessing the same ignorance. Seyd knew better and, a year later, he told Senator Luckenbach:

“Your people will not now comprehend the far-reaching extent of that measure — but they will in after years.”

The Congressional Record of April 1873 described Seyd as a benefactor: “Emest Seyd, of London, a distinguished writer and bullionist, who is now here, has given great attention to the subject of mint and coinage. After having examined the first draft of the bill, he made sensible suggestions which the Committee adopted and embodied in the bill.”

The results were not long in coming. A crisis followed: the panic of 1873, upon which Senator Ferry of Maryland commented: “Millions of people were reduced from good circumstances to penury, or covered with debt, beneath which burden their backs must bend until it is unloaded at the grave, where an innocent posterity must take it up and bear it on.”

The victims of the crisis were no doubt told that this was punishment for their sins or for their transgressions. Ernest Seyd could have provided them with a better explanation.

Among the many bankers who have come and gone, let us mention Paul Warburg, an international financier from London who took part in writing the Federal Reserve Act of 1913, for the establishment of a system of central banks in America, in line with international banking interests.

Financiers at higher levels do not rest. Before the “growling” revolt of a world awakening to reality, they make every effort to uphold their monopoly. At the meeting of the American Bankers Association in Boston, in October 1937, they took care to emphasize the importance of shaping the youth through lessons or lectures discretely supplied by Iocal bankers; through school competitions sponsored and judged by them, etc. For the adult population, the media is to be monitored, articles written by bankers and their publicists are to be inserted, articles that could underwrite the prestige of the banks must be removed, using the influence banks have over advertisers, if need be. In economic faculties, anyone who attempts to expose their deception, are not to be granted tenure.

In Canada, we have adopted the London-based debt-money system, controlled by private banks, with government bonds and public debts. Since 1934, we have our own central bank, the Bank of Canada that has not raised, by so much as one dollar, the purchasing power of Canadians. Notwithstanding its name, it was never meant to improve the condition of the Canadian people. The Secretary of the Bank of England was invited to establish the Bank of Canada. Prime-Minister Bennett is not to be blamed if Mr. Osborn was only offered the title of assistant-governor, for he truly held the top job. It had to look as though the slaves of a colony of international finance were the ones in charge.

In 1935, then Liberal leader, Mackenzie King would tell anyone who cared to listen that if he came to power, he would see to it that government took back the control over money and credit, for democracy has no meaning when bankers have the control over money. Once elected Prime-Minister of Canada, he overthrew laws that had been passed in Alberta which wanted to establish what he had himself promised to estabish in the the whole country, but which he was no longer in no hurry to apply.

Conclusion

ConclusionHow lovely, the history of the monopoly of money that some good Canadians are still eager to defend — and we have known a few! — And see the result! “Those who control money and credit have become the masters of our lives, to such an extent that no one dare breathe against their will.”(Pius XI, Quadragesimo Anno). Someone else added the following half a century ago: «These people want the earth to become their inheritance.”

And thus, the Earth has become their inheritance. What country is not in debt today? If the whole planet is in debt, do we owe these debts to the inhabitants of Mars or Venus? No, all of these debts are owed to an organized clique of public criminals — war-mongers, they who starve women and children, they who poison our lives, “bandits who have replaced their facemask by a white carnation worn on their lapel, and who have given up the gun in favor of a crimson fountain pen. “(Father Coughlin).

It is this international monster before which we kowtow religiously, in submission. History does not offer another example of such idiotic abasement of a whole people, except in the worship of the devil or of the stones and metal idols of centuries past. Then also, did the wisemen of the day defend with their name and prestige, a cult which now leaves us pondering. Then also, did the powers of the day form a hedge around foolish practices, and did an elaborate legislation safeguard the throne of an infernal dictator who was playing mankind. Our children might say the same of our own civilization.