By Louis Even,

First published in January of 1957

Wealth is an object; money is a symbol.

The symbol ought to reflect the object.

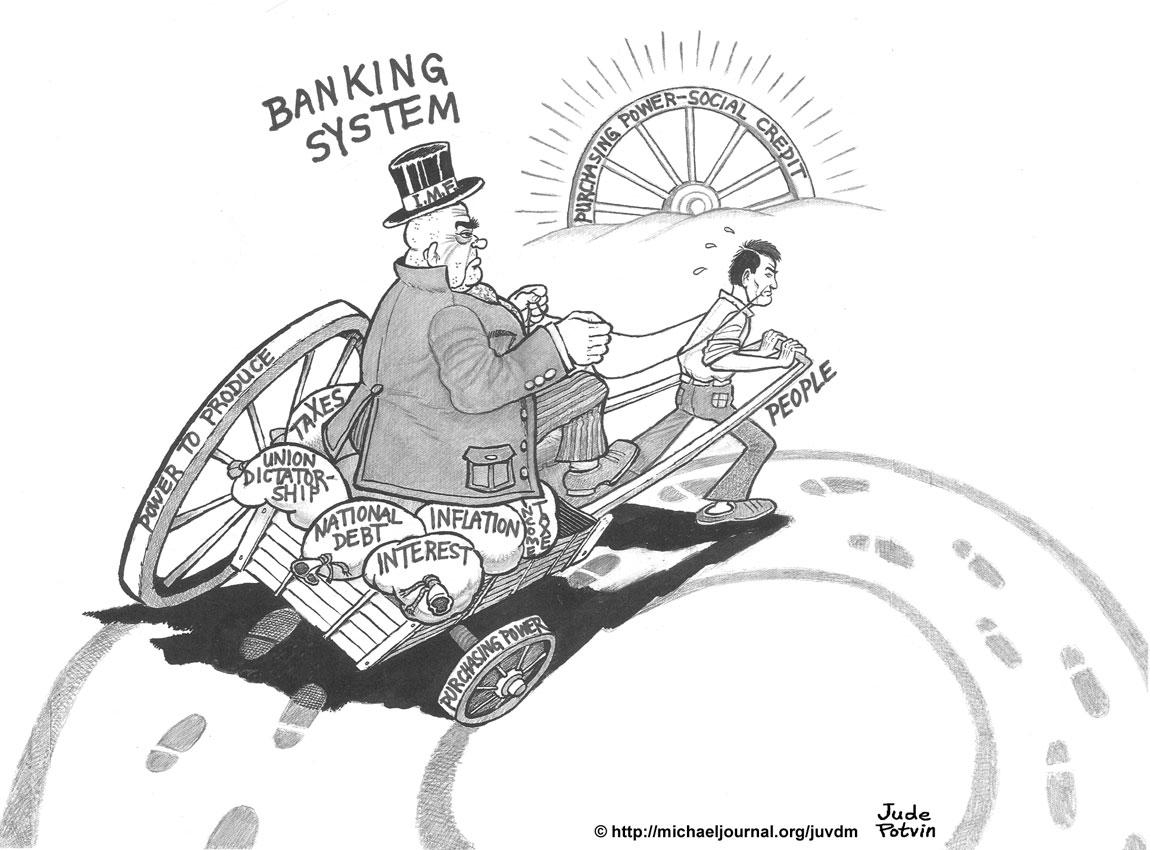

Those who control money and credit have become the masters

of our lives... No one dare breathe against their will. (Pius XI)

Banks create and destroy money. To create

money is an act of sovereignty that must not be linked to a bank.

New money, upon being created, belongs to the citizens,

To all citizens, and should be handed over to them

As a discount on prices and as social dividends.

Earthly goods and temporal needs

Hunger, the need for clothing, for shelter, for heating, for medical care and for rest, are temporal needs that no man can escape as long as he lives. It is the Creator who gave us these needs. It is also He who has placed us here upon earth. Therefore, He must have placed, somewhere on earth, the means to satisfy these needs.

The things needed to satisfy these needs are goods, earthly goods: Food, clothing, firewood, blankets, kitchen utensils and medicines. It is with these earthly goods that man must satisfy his temporal needs.

The aim of man’s economic activities is precisely to make the goods meet the needs. If an economic system does this, it achieves its end. If it leaves goods on one side and needs on the other, it fails. In our country, the economic system misses its objective since it allows many people to go hungry in spite of all the wheat; it allows people to go homeless and without heat in spite of all the wood; to go without medical care in spite of all the available medical services. We must seek to understand why.

What is lacking

Is there anything missing in our country to satisfy the citizens’ temporal needs? Are we short of food so everyone can eat his fill? Are we short of shoes, of clothes? Can we not make all that is required? Are we short of railroads and other means of transportation? Are we short of wood or stones to build sturdy houses for all families? Are we short of builders, of manufacturers, or other workers? Are we short of machinery?

No, we have all of these things and plenty at that. Never do the retailers complain that they cannot find the goods they need to answer the demand. Grain elevators are bulging. There are many able-bodied men looking for work. A lot of machinery is also lying idle.

Yet, a great many people suffer! Goods are simply not finding their way into the homes.

What is the use of telling people that their country is rich, that it exports a large amount of products, that it ranks third of fourth among the world’s exporting countries?

What goes out of the country does not go into the citizens’ homes. What sits idle in the stores does not appear on their tables.

A mother does not feed her children nor provide them with shoes and clothing by going window-shopping, by reading advertisements in newspapers, by listening to the description of wonderful products on the radio, or by listening to the sales pitch of countless salesmen.

What is lacking is the title to these goods. You cannot steal them. To get them, you must pay for them; to do this you need money.

There are plenty of good things in our country, but many individuals and families lack the right, the permission, to obtain the things they need.

Is there anything missing except money? What is missing aside from the purchasing power needed to make products go from stores to homes?

Warehouses are filled to capacity:

A calamity for the producers,

While millions are starving.

The culprit:

A dysfunctional monetary system

Modern crises

Money and wealth

This does not mean that money itself is wealth. Money is not an earthly good capable of satisfying temporal needs.

You cannot feed yourself by eating money. To clothe yourself, you cannot sew dollar bills together to make a dress or a pair of stockings. You cannot rest by lying down on money. You cannot cure yourself by putting money on the seat of the ailment. You cannot educate yourself by crowning your head with money.

No, money is not wealth. Wealth is the useful things that correspond to human needs.

Bread, meat, fish, cotton, wood, coal, a car on a good road, a doctor's visit to the sick, a teacher's knowledge — these are wealth.

But, in our modern world, each individual does not produce all the things he needs. People must buy from one another. Money is the symbol we get in return for something we sold; it is the symbol we must hand over to get something offered by someone else.

Wealth is an object; money is a symbol. In all logic, the symbol ought to reflect the object.

If there are a lot of things for sale in a country, there must be a lot of money available to dispose of them. The more people and the more goods, the more money required in circulation, or else everything grinds to a stop.

It is precisely this equilibrium which is often absent. We have at our disposal all the goods we may wish to make, thanks to applied science, to new discoveries, and to the perfecting of machinery. We even have people, forced into unemployment, who represent a potential for more goods. We have loads of useless, even harmful occupations. Many of our activities are directed at destruction.

Why is it that money, which was created for the purpose of keeping goods moving, does not find itself in the consumers' hands in relation to the products that were intended for them?

Money begins somewhere

Everything, except God, has a beginning. Money is not God, therefore it has a beginning. Money begins somewhere.

We know where such useful commodities as food, clothing, shoes and books begin. Workers, machinery plus the country’s natural resources, give birth to the wealth, to the goods we need and for which there is no lacking of.

But where does money begin, the money we lack to buy the goods, there is no lacking of?

The first idea that comes to mind, without our realizing, is that a fixed amount of money exists and that it cannot be changed; as though it were the sun or the rain, or the weather. Wrong: If money exists, it is because it was made somewhere. If its quantity is limited, it is because those who made it did not make more of it.

Another prevalent belief: When we ask ourselves the question, we think that the Government makes money. This is also incorrect. Nowadays, the Government does not create money, and complains non-stop about not having any. If it made money, it would not have sat around idly, during ten years, in front of a lack of money. The Government taxes and it borrows, but it does not create money.

We will explain where money begins and where it ends. Those who control the birth and the death of money also regulate the amount of money in circulation. If they create a lot of money while they destroy little, there is then more money in circulation. If the amount of money destroyed is greater than the amount created, the quantity of money in circulation decreases.

In a country where there is a shortage of money, the standard of living is not regulated by the amount of goods, but by the amount of money we have to buy these goods. Therefore, those who control the amount of money being circulated, also control our standard of living.

“Those who control money and credit have become the masters of our lives... No one dare breathe against their will.” (Pope Pius XI, Encyclical Letter Quadragesimo Anno).

Two kinds of money

Money is whatever serves to pay, to buy; whatever is accepted by everyone in exchange for goods or services within a country.

The material substance of which money is made is of no importance. In the past, money has at times been made of shells, leather, wood, iron, silver, gold, copper, paper, etc.

There are at present two kinds of money in Canada: one we call pocket money, made of metal or paper; and the other we shall call bookkeeping money, made of figures in a ledger. Pocket money is the least important; bookkeeping money is the most important.

Bookkeeping money is the bank account. Business operates through bank accounts. Whether pocket money circulates or not depends on the state of business. But business does not depend upon pocket money; it is kept going by the bank accounts of businessmen.

With a bank account, we make payments or purchases without using metal or paper money. We buy, using figures.

Let us suppose I have a bank account of $40,000. I buy a car worth $10,000. I pay with a check. The car dealer signs the check and deposits it at his bank.

The banker will make changes to two accounts: First, that of the car dealer, which he increases by $10,000; then mine, which he decreases by $10,000. The car dealer had $500,000 — he now has $510,000 written in his bank account. I had $40,000 in mine — my bank account now shows $30,000.

The amount of paper money did not change in the country following this transaction. Figures were simply transferred to the car dealer. I paid with figures.

More than nine-tenths of all business is done this way. Bookkeeping money, money made of figures, is what modern money is made of; it is the most abundant money, its volume is ten times the other’s; it is a superior type of money, it gives wings to the other; it is the safest, the one that no one can steal.

Saving and borrowing

Bookkeeping money, like paper money, has a beginning. Since bookkeeping money is an entry in a bank account, it comes into existence when a bank account is opened without money having decreased nowhere, not in another bank account nor in anyone's pocket.

The amount in a bank account can either be created or increased in two ways: through savings or through loans. There are other ways, but they can be classified as loans.

The savings account is a conversion of money. I bring some pocket money to the banker; he increases my account by the same amount. I no longer have the pocket money; I have bookkeeping money at my disposal. I can get some pocket money back by decreasing the amount of bookkeeping money in my account. It is a simple conversion of money.

But since we are trying to find out how money comes into existence, the savings account, being a simple conversion of money, is of no interest to us here.

The loan’s account is the amount lent by the banker to a borrower.

Let us suppose I am a businessman. I want to set up a new factory. All I am missing is money. I go to a bank and borrow $100,000. The banker makes me sign the required loan guarantees and a promise to pay back the amount plus interest. He then lends me the $100,000.

Is he going to hand me the $100,000 in paper money? I do not want him to do so. First, it is too risky. Furthermore, I am a businessman who buys things from many different and far away places, using cheques. What I want is a bank account of $100,000 which will make it easier for me to carry on business.

The banker will therefore lend me an amount of $100,000. He will credit my account with $100,000, just as if I had brought that amount to the bank. But I did not bring it; I came to get it.

Is it a savings account, set up by me? No, it is a loan’s account created by the banker for my use.

The money maker

This amount of $100,000 was made not by me, but by the banker. How did he make it? Did the amount of money in the bank decrease when the banker lent me $100,000? Well, let us ask the banker:

— Mr. Banker, is there less money in your vault after your having lent me $100,000?

— I haven't gone into my vault.

— Have other people's accounts been decreased?

— They remain exactly as they were.

— Then what was decreased in the bank?

— Nothing was decreased.

— Yet my bank account has been increased. Where did the money you’re lending me come from?

— It didn't come from anywhere.

— Where was it when I came into the bank?

— It did not exist.

— And now that it is in my account, it exists. So we can say that it was created.

— Certainly.

— Who created it, and how?

— I did, with my pen and a drop of ink when I entered $100,000 to your credit, at your request.

— Then you create money?

— The bank creates bookkeeping money, the modern money that allows the other type of money to circulate by keeping business going.

The banker makes money, ledger money, when he lends money to borrowers, be they individuals or governments. When I leave the bank, there will exist in the country a new source for the issuance of cheques that did not exist before. The total amount of all of the country’s accounts was raised by $100,000. With this new money, I will pay workers, buy materials and machinery — in short, I will build my new factory.

Whomakes the new money?

— Bankers do.

The destroyer of money

The banker, and the banker alone, creates this kind of money: script money, the money that keeps business rolling. But he does not give it away. He lends it. He lends it for a certain period of time, after which it must be returned to him. He must be repaid.

The banker claims interest on the money he created. In the case mentioned above, for a $100,000 loan, the banker will probably ask $10,000 in interest to be paid at once. He will withhold the amount from the loan and I will leave the bank with $90,000 in my account, having signed a promise to repay $100,000 in a year’s time.

In building my factory, I will pay out wages, buy materials and I will spend the $90,000 from my bank account throughout the country.

But within a year, I must make profits, I must sell my products at a higher price than they have cost me, so that through my sales I might build myself another bank account of no less than $100,000.

At the end of the year, I will pay back the loan by writing a check for $100,000 on my account. The banker will then debit my account by $100,000, therefore taking from me this $100,000 I have drawn from the country by selling my goods, and he will not return this money to anyone else’s account. No one will no longer be able to draw checks on this $100,000. This money has passed away.

Borrowing gives birth to money. Repayment causes it to die. Bankers bring money into existence when they make a loan. They send money to the grave when loans are paid back.

Bankers are both the makers and the destroyers of money.

And the system operates in such a way, that the repayment must be greater than the original loan; the death figures must exceed the birth figures; the destruction must exceed the creation.

This seems impossible and, collectively, it is impossible. If I succeed, someone else must go bankrupt; because, when taken as a whole, we are unable to repay more money than has been made. Bankers only create the capital. No one creates the interests, since no one else creates money. Yet, bankers ask that both capital and interest be repaid. Such a system cannot last unless further loans are issued in ever greater numbers. From whence our debt system and the strengthening of the dominating power of the banks.

The national debt

The Government does not create money. When the Government can no longer tax nor borrow from individuals, due to the scarcity of money, it borrows from the banks.

It follows the same procedure as I did. As a guarantee, it pledges the whole country. The promise to pay back is the debenture. The loan is created by pen and ink.

In October 1939, the Federal Government, in order to cover the initial expenses of the war, asked some $80,000,000 from the banks. The banks lent the Government an amount of $80 million without taking a cent from anyone, thus giving the Government the means to write 80 million dollars worth of cheques.

But, in October 1941, the government had to repay $83,200,000 to the banks: Interest added to capital.

Through taxes, the government must remove from the country all the money it has spent, $80 million. It must also remove a further $3 million, money that was not put into circulation, that neither the banker nor anyone else has created.

The Government might succeed in recouping money that exists, but how can it possibly find money that was never created?

The fact is that the Government cannot find this money and it simply adds this to the national debt. This explains why the national debt grows at the rate money is required to develop the country. All new money is created as a debt by a banker, claiming more money than was issued.

And the country's population finds itself collectively thrust deeper and deeper into debt for a production it has itself made. This is the case for war production. It is also the case for peacetime production: for roads, bridges, waterworks, schools, churches, etc.

The monetary defect

The situation can be summed up in this inconceivable way: All the money in circulation came from a bank. Even metal and paper money come into circulation only after it having been released by a bank.

Now, banks put money into circulation only by lending it out at interest. This means that all the money in circulation came from the banks, and must someday be returned to the banks, with the added interest.

Banks remain the owners of the money. We are only leasing it. If some people manage to hang on to their money for a long period of time, or even permanently, others are necessarily incapable of fulfilling their financial commitments.

An increasing number of bankruptcies, for both individuals and companies, mortgages upon mortgages, and continued growth of public debts, are the natural fruits of such a system.

Claiming interest on money as it is created is both illegitimate and absurd, antisocial and anti arithmetic. The monetary defect is therefore a technical defect as well as a social defect.

As the country develops, production-wise and population-wise, more money is needed. But it is impossible to get new money without contracting a debt which collectively cannot be paid.

We are left with two choices: We either stop development or go deeper into debt; we either join the unemployed or we contract unpayable loans. All countries now face this dilemma.

Aristotle, and later Saint Thomas Aquinas, wrote that money does not breed money. But the banker only creates money under condition that it should breed more money. Since neither governments nor individuals create money, no one creates the interest claimed by the banker. Even when legalized, this way of issuing money remains vicious and insulting.

Forfeiting of power and abject poverty

This way of making the country’s money, by forcing governments and individuals into debt, establishes a real dictatorship over governments and individuals alike.

Sovereign Government has become a signatory of debts owed a small group of profiteers. The minister, who represents millions of men, women and children, signs unpayable debts. The banker, who represents a clique interested only in profit and power, manufactures the country’s money.

This is a striking aspect of the forfeiting of power spoken of by the Pope: "Governments have surrendered their noble functions and have become the servants of private interests."1

The Government, instead of ruling the Country, has become a mere tax collector; and its largest expenditure is none other than the payment of interest on the national debt.

Administration consists mainly in taxing people and legislation is used mainly to place limits on individual freedom.

There are laws to ensure that the creators of money be repaid. There are no laws to prevent a human being from dying of extreme poverty.

As for individuals, the scarcity of money leads them to adopt a dog eat dog mentality. In front of abundance, people must fight to get a hold of some of the precious tokens that give access to abundance. Ensues unbridled competition, patronage, denunciations, dictatorship of labourers, domestic strife, etc.

A small number of individuals preys on the others; the greater number laments itself, with many in the most degrading poverty.

The sick remain without care; children are poorly or insufficiently nourished; talents cannot be developed; the young can neither find a job nor start a home or family; farmers lose their farms; industrialists go bankrupt; families struggle along with difficulty — with no other justification than the lack of money. The banker’s pen imposes privation on the people, servitude on governments.

Whose duty is it to create money?

It was Saint Louis, King of France, who said: “It is the first duty of a king to mint coins when money is lacking for the sound economic life of his subjects.”

It is not at all necessary, nor is it advisable that banks be abolished or nationalized. The banker is an expert in accounting and investments. Let the banks continue to receive and invest savings for profit, taking their share of profits. But the creation of money is an act of sovereignty which cannot be left to a bank. Sovereignty must be removed from the bank and returned to the Nation.

Bookkeeping2 money is a good invention that should be maintained. But instead of drawing its origin from a private pen, in the form of a debt, the figures we use as money should be born from the pen of a national organism, in the form of money destined to serve.

There is no need to change anything to ownership and expertise. No need to abolish the current money to replace it with some other kind of money. All that is needed is for a social monetary organism to add, to the money that already exists, more of the same money in accordance to the country’s possibilities and the population’s needs.

We must put an end to sufferings from privation when there is, available in the country, all of the things needed to bring comfort to every home.

Money must come into circulation according to the country's productive capacity and the wish expressed by consumers for useful goods that can be made.

It is therefore the producers and consumers as a whole, the whole of society, who, in producing goods to answer needs, should determine the amount of new money that an organism, acting in the name of society, should put into circulation from time to time, in accordance with the country's achievements.

Thus the people would recover their right to live fully their lives as humans, in accordance with the country's resources and the great possibilities of modern production.

Who owns the new money?

Money, then, should be put into circulation according to the rate of production and as the needs of distribution dictate. But to whom does this new money belong when it is created?

— It belongs to the citizens. It does not belong to the Government since it is not the owner of the country, but only the custodian of the common good. Nor does it belong to the accountants of the National Credit Office: In the same way that judges do, they perform a social function for which they are paid, according to law, by society. This money belongs to the citizens and to them alone.

To which citizens? — To all citizens. This money is not a salary. It is new money injected into the public so that, as consumers, they may obtain goods already made or that could readily be made, products that are only awaiting sufficient purchasing power to be bought or ordered.

One cannot imagine for a minute that this new money, issued free by a social organism, ought to belong to a single individual or to a private group.

There is no other way, in all fairness, of putting this new money into circulation than to distribute it equally among all citizens. It is also the best way to make this money efficient since it will be distributed throughout the country.

Let us suppose that the accountant who acts in the name of society, finds it necessary to issue 21 billion dollars. This issue can be made of bookkeeping money; a simple entry in a book, as is the case with the banker's entries today.

But since there are some 30 million Canadians and $21 billion to distribute, each citizen would receive $700. So the accountant would add $700 in the account of each citizen. These individual accounts could easily be managed by the local post office or by local banks..

This would be a national dividend. Each Canadian would have an extra $700 added to his own credit, in an account established for this purpose.

To each a dividend

Each time it becomes necessary to increase the amount of money in the country, each man, woman and child, regardless of age, would get his or her share of the new level of progress which caused the new money to be issued.

This is not payment for work done. It is a dividend to each individual for his share in a common capital. Private property does exist. But common property also exists: common goods owned equally by all.

Here is a man who has nothing but the rags he is covered with. Not a meal before him, not a penny in his pocket. I can say to him:

“My dear fellow, you think you are poor, but you are a capitalist who owns a great many things, as many as I own and, for that matter, as many as the Prime Minister himself owns. The Province’s waterfalls, the Crown's forests are yours as well as mine, and they can easily bring in an annual income.

“The social organization that allows us to produce a hundred times the goods at a hundred times the speed we would produce if we lived in isolation, is yours as well as mine. It must be of benefit to you as well as to myself.

“Science, which allows production to be multiplied while using barely any labour at all, is a heritage passed on and increased through generations. And you, a member of my generation, should have a share in this legacy just as I should.

“If you are destitute, my friend, it is because your share has been stolen from you. Worse still, it was put under lock and key. The current unemployment as well, as your needs, are the result of this.

“The Social Credit dividend will give you back your share, or at least the better part of it, and an administration freed from the financiers’ influence and better suited to bring these exploiters to reason, will allow you to get the rest.

"This dividend will also be a recognition of your title as member of the human race by virtue of which you have a right to a share of the world’s goods or, at least, to that part needed to exercise your right to live.”

And they still hesitate to change the wheel!

Price regulation

The dividend, added to salaries and other sources of income, goes to make up purchasing power.

But there are people who do not need all their money for purchases, and prefer to save or invest some of it. This reduces the total amount of effective purchasing power. Only the money that is used to buy goods makes up purchasing power that is immediately effective.

For this and for other reasons, the equilibrium between prices and purchasing power cannot be reached simply by giving a dividend to all. However, Social Credit provides for this through a regulating mechanism which, while respecting individual freedom, allows the savings of the wealthy to be of profit to all, while preventing prices from going up.

This mechanism is the adjusted price (adjusted, not fixed); it is also called the compensated price, or the compensated discount. There is nothing factitious about it. It reflects with precision the facts pertaining to the production and onsumption of the real wealth.

For instance, if the national accounts show that during the course of one year, the country's total production has reached a value of 30 billion dollars while total consumption (including depreciation) totaled 24 billion dollars, we may conclude that, while consuming $24 billion of wealth through consumption and depreciation, the country has produced 30 billion dollars worth of wealth. The production of 30 billion dollars worth of wealth has in fact cost us, collectively, only $24 billion.

The real price is lower than the accounting price. In order that the population might fully reap the fruit of its work, it must be given a discount of 6 billion dollars; that is, it must be made to pay only 24 billion for what is written down in the books as 30 billion.

To this end, the National Credit Office would decree a general discount of 20 per cent on all retail sales for the coming period. If I buy an article marked at $10, I will pay only $8.

But, in order to stay in business, retailers and producers must recover all their costs. For this reason, the same monetary commission will compensate the retailer, by creating the necessary amount of money. For a $10 article, I gave $8 to the retailer. Upon presentig his sales voucher to the local branch of the Credit Office, the retailer will receive the $2 that was discounted.

Consumers will obtain the products that would have remained unsold otherwise. The retailers get to cover their costs. And this creation of money does not cause inflation; on the contrary, it leads to the lowering of all consumer prices.

This price adjustment would benefit both the retailer and the buyer. In fact, conventions could be reached guaranteeing that all costs would be met but holding that profit margins would be kept within limits for each line of business.

Objection: Gold

— But money must be based on gold!

— Money draws its value from production and from the confidence we have in one another. Empty the country of all of its useful production, it then becomes a desert. Of what use would money be, even if it were gold? On the contrary, leave the country as it is, with all kinds of possible production, with the money needed to pay for it, whether it be paper or merely figures, and see whether this money is accepted everywhere and whether it is used to order all kinds of useful things.

— What about the gold standard?

— The gold standard is used to define the monetary unit of each country. It allows one to compare the monies of the different countries. If you say that the dollar is worth 40 grains of gold, it means that you get, for a dollar, 40 grains of gold or an equivalent amount of merchandise. Whether the gold is there or not, if the goods exist, you can trade them for your dollar.

— But will money that is not backed by gold be good abroad?

— Money is a national matter. Dollars do not circulate in France, nor do francs circulate in America. French buyers or retailers do not ask themselves whether Canada and the United States have many or few dollars in circulation. What they are interested in is how much one dollar can buy. If you double the Canadian production while doubling the amount of dollars, won’t each dollar buy the same number of things as before? This is the only way the purchasing power of the dollar can be maintained, a factor that is so vital to international trade.

Since May 1, 1940, the Bank of Canada no longer uses gold to back up the dollar: Is the dollar less acceptable than it was on April 30, 1940?

The gold myth is an illusion that the masters of money and credit keep alive to foster their plans. Is it not ridiculous to condition a man's right to eat by the amount of gold in existence rather than by the amount of food available? The same applies to other goods.

Objection: Laziness

— Social Credit will make people lazy.

— Why?

— Because it wants to increase the amount of money, and money makes people lazy.

— It is precisely when there is money in circulation that goods are sold; and when goods are sold, industry can supply work to its employees. Working does not make a man lazy; being condemned to inactivity does.

Moreover, laziness is a sin — one of seven deadly sins. It is not through financial means that sins are forgiven. It is not the role of finance to take the place of education, of morals, of prayer, of the sacraments, or of religion.

— Yes, but this free money guaranteed to everyone…

It is not free money. It is an income derived from a capital that belongs to everyone. And it is money that can be used to buy goods that are waiting to be bought.

The guarantee of a minimum income, instead of making man lazy, places him in a position where he can find work where his aptitudes are best put to use, for the greater benefit of all.

There are no better workers than those who work at a job they like, a job of their own choosing; not hard labor, not a career imposed by a dictatorship, but a work freely chosen.

The dividend makes up part of the purchasing power needed to buy products. This implies that men and machinery must be set to work to meet the demand for these products. Obviously, if production should stop, money could no longer be called purchasing power since there would be nothing to buy. Under such circumstances, the creation of money would not reflect realities. But Social Credit works according to realities.

Like the workers’ wages and salaries, a universal dividend would stimulate production, since it would grow as production increases.

A universal dividend would have no effect on the wages and salaries of those employed in production. The difference of income would remain the same between a man having only a dividend, and a man having a dividend and a salary.

Objection: Communism

— Giving everyone the same amount of money will place everybody on an equal footing; that's Communism!

— The dividend will not make incomes equal. Peter has $100,000. Paul has $100. If I give each of them $40, will they be equally wealthy? Each is better off than he was before, but the poor man will benefit the most.

— Something for nothing, that's Communism!

— Not at all. What does Communism want? When Communism demands that everyone have the same economic status, it is mistaken. But when we ask for each human being the right to the basic necessities of life, because God created material goods for all humans alike, this is not Communism but Christian sociology. It is the law of "usus communis". If some Communists recall it to a world that has forgotten it, they are right to do so. The other law, that of private property, it too is a just law, and the capitalists are right to uphold it, just as the Communists are wrong to deny it.

The same way the Church does, Social Credit wants both laws to be observed. Social Credit, by its dividend to all, offers a method that would guarantee, by law, to everyone, a minimum share of the goods created for all men. By balancing global purchasing power against prices, it would facilitate the sale of existing stocks thereby consolidating private property.

Communism wants to enslave everyone to the State. Social Credit, by guaranteeing a vital minimum to all, would allow people to find jobs related to their aptitudes; by making production profitable, it would free the citizens from continually having recourse to the State's intervention and to grants that lead to the limitation of freedom.

Moreover, a committee of theologians, appointed by the Quebec bishops, studied Social Credit in 1939 and were unanimous in declaring that in Social Credit there is no sign of either Communism or Socialism that are both condemned by the Church. In their report, they made interesting comparisons between Pope Pius XI's encyclical and the monetary propositions of Social Credit.

Opposition: Who and why?

Are there people opposed to Social Credit? Yes indeed, and here are some of them:

The bigwigs at the helm of banks and related trusts are opposed to Social Credit. They foresee the end to their precious monopoly and to the means by which they take advantage of the public.

Their political lackeys who are more interested by electoral funds than by the people’s needs, support the bankers' opposition. Political parties have not included Social Credit in their platform because they would rather listen to the voice of their sponsors and because the people at large do not make their voices heard since they lack the proper information.

Those who practice patronage are generally opposed to Social Credit; if the public had money, their influence would be lost.

Some of the newly rich are opposed to Social Credit because they like to shine by casting a shadow over those who own nothing. They fear that people, having no longer to crawl for the right to live, might begin to judge men by their moral value rather than by the size of their wallet.

Different kinds of ignoramuses are opposed to Social Credit. Some know nothing of Social Credit, yet they condemn it through a lack of judgment or through prejudice. Others misinterpret it and imagine that their fortune will be confiscated. Others believe that people must be poor to behave properly; they acknowledge that they themselves are quite capable of making proper use of money, but they look upon their neighbors as professional sinners and find that bankers contribute to man’s salvation! There are others still who are so married to their own pet beliefs that they refuse to admit, through pride or narrow-mindedness, that beliefs other than their own might have any merit.

Bear in mind that the opponents affirm or deny but they offer no proof. Or they do so by distorting Social Credit so as to be able to attack it. One such critic, the ex-Dominican Thomas Lamarche, went as far as to translate falsely some writings so as to give them an arbitrary meaning: This is not ignorance but outright dishonesty.

Order restored

What effect would Social Credit have?

First of all, order would be restored in money matters and through this in economics, with resulting improvements to the political and social spheres.

Man comes immediately after God and the angels. Like all things lacking reason, money must be subjected to man.

Today, money is given birth in a ledger which process throws mankind into debt. Money is made master upon being created. Man, on the other hand, is born indebted to finance. He is born a slave to money.

Under a Social Credit system, money would still be born in a ledger, but it would be at the service of each citizen. Children would be born with a right to a dividend; money would be at their service from the day they are born.

Order would be restored to economics. The end goal would guide economic activities. Goods would be made to answer needs. Money would cease to be the ultimate goal of industry.

The standard of living would reflect the quantity of goods that are available: There would be as much money as there are goods for sale.

Money would once again become what it ought to be, an instrument to insure the flow of goods, not a weapon to confer power over individuals.

A mere symbol to represent wealth, money, which gives claim to useful things, would be the exact reflection of wealth, of the things that are useful and available. It would therefore be in constant relation with that part of production that corresponds to needs.

Wages and salaries would be issued for production that requires human labor; easily acquired money, for production that is easily made; abundant money, for abundant production; free money, for automatic production; money issued by a social organism and distributed to each and everyone, for production that is increased owing to the investment of a common capital, itself a social factor.

A country’s development would no longer be represented by a debt, but by a general increase in prosperity that would benefit everyone.

Security achieved

The first thing man seeks, as regards temporal matters, is security, the preservation of his life. It is for a greater protection against his enemies — wild beasts, hunger, cold — that he associates himself with his fellow men.

He is even ready to sacrifice part of his freedom in order to have at least a minimum of economic security.

What stands in the way of economic security today? What inspires in a man the fear for tomorrow, for his old age? Again, let us take Canada as an example. Is there a single Canadian who fears that tomorrow, or in several years, Canada will be unable to produce enough wheat, enough food to satisfy the hunger of all the country's inhabitants? Who is afraid that Canada will no longer be able to provide enough clothing, enough shoes, enough construction material, enough firewood, enough coal, etc.?

No, what prevents us from having confidence in tomorrow is our fear of not having enough income, of not having enough money to buy a sufficient share of these things. Nothing guarantees our having this security today.

If money were to keep in step with production, if enough money was distributed so as to guarantee by law that everyone had enough to ward off want, we should immediately witness the advent of economic security, in a country that lacks nothing.

Well, it is this security for each and everyone, without exception, that the monetary system of Social Credit would guarantee.

There would be enough money for all goods to be sold. Everyone would be guaranteed his share of production; other revenues being determined by one’s contribution to production. The share of production to be distributed by social dividends would increase as machinery, applied science, inventions and technological improvements decrease the amount of labour required to maintain production.

Freedom

From this very security, freedom ensues, a freedom so precious to man that, once he is guaranteed life’s necessities, he will prefer to keep his freedom rather than to trade it for more luxury.

Freedom is nothing but a vain word if, in order to avail himself of it, one must submit to starving.

Slaves had no freedom. The system of money slavery offers none either. Even those who do well financially, often through violence or the absence of scruples, cannot enjoy their success freely, because the peace of mind needed for real freedom, is not compatible with fratricidal methods. The free enjoyment of material goods is not compatible, even when success is honestly achieved, in a world where too many of our fellow men suffer unjustifiably.

For the first time in history, man will be freed from the bonds cast about him by other men who exercise their power through money. If, by itself, this deliverance from money does not give man true freedom, man can then choose to exercise it by regulating his own life.

The freedom to express one's thoughts, recognized in principle, but suppressed for most people because of their reliance on party politics or on companies that use their power to intimidate their employees.

Freedom to choose one's career in a world where doors will no longer be closed because of a lack of money.

Freedom to marry, to build a home and family, once life’s basics needs and the possibility of finding a job are guaranteed.

Freedom to raise children once a periodic dividend to each member of a family has been granted to offset the rising costs of raising a family.

Freedom to cultivate one’s faculties, to use one’s creative energies in a world where progress, instead of creating unemployment, engenders leisure without curtailing incomes.

Governments

If governments do not govern today, it is because they have become the lackeys of private interests. They incur debts towards bankers who manufacture money. Even the most capable men, upon ascending to power, are thrown into a straight jacket by the creators of debt.

Instead of governing the country according to the country's real potential, they must submit to restrictions imposed upon them by a system based on the scarcity of money. The country's leaders stand handcuffed, at the helm.

Rulers, especially those closest to the people such as municipal administrators, find themselves completely baffled by the problem of trying to find money where there is none. They can only raise money, for emergencies, by increasing the country's national debt and the tax burden, without making improvements to the services they offer.

Governments found at the helm should have no other task than to watch and coordinate the various organisms found under them, the social bodies which, arranged in hierarchical order, make up the true State in a most natural manner, as is the case with a true corporate system. But, instead, all of these social bodies, these corporations, even the most fundamental, i.e. the family, have become lifeless ruins. And what do we see? Individuals, families, groups that jostle and wrangle over whatever little money the government manages to snatch from those who have not yet hit bottom.

Social Credit would restore to the governments their proper functions. It would put money back into circulation, "the lifeblood of economic life". Individuals would be free to form anew their own natural groupings. These groupings, these various corporations, would become financially capable of settling the problems lying within their jurisdiction; this would facilitate the task of the higher levels of government.

Freed from unsolvable budgetary nightmares, freed from the monetary powers, the government would be in a better position to intervene whenever the security of our social order were threatened by saboteurs, even by wealthy ones.

The Social Credit Movement

Many great minds have criticized a monetary system that serves mankind so poorly. But it was Major Douglas, a Scottish engineer, who, in 1918, first formulated the system called Social Credit. It is a system the most in keeping with modern progress; the most democratic; the only one which puts money directly at the service of man, of all men; also the only one that increases automatically the income of a family as the family itself grows in size.

The study of this system gave birth to a movement whose purpose is to demand its implementation. The Social Credit movement spread to all English-speaking countries, as far as Australia and New Zealand, but especially in Canada, and primarily in Alberta where it first took root; then, dressed with a French habit and a Catholic philosophy, it spread to the Province of Quebec, and from there to French Canada.

In the Province of Quebec and in all parts of French Canada, since 1935, the Social Credit Movement grew to imposing proportions, all the while instilling in people the habit of studying public matters.

The Social Credit Movement radiating from Quebec is led by the Pilgrims of Saint Michael. Vers Demain is published in French since 1935, and its English counterpart, Michael, since 1953. (Michael is also published in Polish and in Spanish). Several Social Credit books and documents have been published over the years. These writings are meant to form enlightened and vigilant citizens who are invited to join together in a “Union of Citizens”, the formula they have adopted to achieve results in politics.

We believe the Province of Quebec has a most important role to play in demanding and, if need be, in instituting the financial reform advocated by Social Credit. This province is largely endowed with natural resources and it is quite capable of shielding itself from all exterior intervention. It has the best-prepared population, through its Catholic education, to understand that money must serve the human being, and to dare bring about a change to an economic system that one of the Popes denounced for making salvation difficult for a considerable number of Christians.

An Apostolate of Education

The way to obtain Social Credit is obviously to form a public opinion sufficiently enlightened and strong to successfully demand its implementation. What is needed, therefore, is an Education campaign, not an election campaign.

This is the best guarantee for the future of Social Credit. Only a well-informed citizenry can exercise the vigilance needed to protect the common good against attempted sabotage on the part of unscrupulous or incompetent politicians.

Under a Social Credit system, problems will no longer have to do with financing; they will have to do with educating, with the choosing of directions, with evaluating. Try discussing these matters with a people nailed down to the grim reality of material want or accustomed to thinking as a herd of slaves would. Study is a prerequisite to obtaining Social Credit: At the same time, it prepares one’s mind to the solving of new problems that might arise in the future.

Leading people to study requires the devoted efforts of numerous apostles who are not afraid of self-abnegation and sacrifice. And this is within the order of things. The present lack of order springs from egoism and pride, from the stifling of the social spirit, from the spirit of the Pharisees that reigns in the intellectual classes, from the listless apathy of the masses. All of which must be expiated and corrected.

The surest and only way of advancing the cause of Social Credit is the method that begets study and devotion. Such is the method adopted by the Pilgrims of Saint Michael, with the "Vers Demain" and "Michael" Journals.

These journals popularize notions in politics, economics, sociology, and even in philosophy. The Pilgrims of Saint Michael, by their dedication, bring their journals and other Social Credit writings to the families.

The Pilgrims of Saint Michael invite people to meetings. They hold study-sessions where all are invited. They train citizens to personal initiative, to personal responsibility, and to concerted actions for the pursuit of the common good.

Next chapter -A Primer of Social Credit