Page 25 - HQ May June July 2020

P. 25

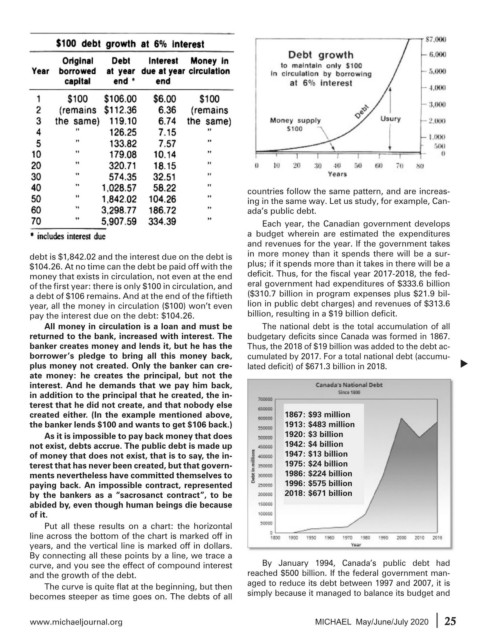

countries follow the same pattern, and are increas-

ing in the same way. Let us study, for example, Can-

ada’s public debt.

Each year, the Canadian government develops

a budget wherein are estimated the expenditures

and revenues for the year. If the government takes

debt is $1,842.02 and the interest due on the debt is in more money than it spends there will be a sur-

$104.26. At no time can the debt be paid off with the plus; if it spends more than it takes in there will be a

money that exists in circulation, not even at the end deficit. Thus, for the fiscal year 2017-2018, the fed-

of the first year: there is only $100 in circulation, and eral government had expenditures of $333.6 billion

a debt of $106 remains. And at the end of the fiftieth ($310.7 billion in program expenses plus $21.9 bil-

year, all the money in circulation ($100) won’t even lion in public debt charges) and revenues of $313.6

pay the interest due on the debt: $104.26. billion, resulting in a $19 billion deficit.

All money in circulation is a loan and must be The national debt is the total accumulation of all

returned to the bank, increased with interest. The budgetary deficits since Canada was formed in 1867.

banker creates money and lends it, but he has the Thus, the 2018 of $19 billion was added to the debt ac-

borrower’s pledge to bring all this money back, cumulated by 2017. For a total national debt (accumu-

plus money not created. Only the banker can cre- lated deficit) of $671.3 billion in 2018. u

ate money: he creates the principal, but not the

interest. And he demands that we pay him back,

in addition to the principal that he created, the in-

terest that he did not create, and that nobody else

created either. (In the example mentioned above, 1867: $93 million

the banker lends $100 and wants to get $106 back.) 1913: $483 million

As it is impossible to pay back money that does 1920: $3 billion

not exist, debts accrue. The public debt is made up 1942: $4 billion

of money that does not exist, that is to say, the in- 1947: $13 billion

terest that has never been created, but that govern- 1975: $24 billion

ments nevertheless have committed themselves to 1986: $224 billion

paying back. An impossible contract, represented 1996: $575 billion

by the bankers as a “sacrosanct contract”, to be 2018: $671 billion

abided by, even though human beings die because

of it.

Put all these results on a chart: the horizontal

line across the bottom of the chart is marked off in

years, and the vertical line is marked off in dollars.

By connecting all these points by a line, we trace a

curve, and you see the effect of compound interest By January 1994, Canada’s public debt had

and the growth of the debt. reached $500 billion. If the federal government man-

The curve is quite flat at the beginning, but then aged to reduce its debt between 1997 and 2007, it is

becomes steeper as time goes on. The debts of all simply because it managed to balance its budget and

25

www.michaeljournal.org MICHAEL May/June/July 2020 25