All the countries in the world are presently struggling with a debt problem. Third-World countries’ debt is over $1,300 billion (in 1986), and most of these Third-World countries are not even capable to meet the interest payments on their foreign debts.

More developed countries, like Canada and the United States, do not escape this crisis: Canada's federal debt – $224 billion in 1986, is over $500 billion in 2004. And the richest country in the world, the one with the largest production — the United States — is also the most indebted country, with a debt of over $2,073 billion in 1986 (over $7,000 billion in 2004). Is there not a contradiction here? How can a country be rich and debt-ridden at the same time? Is the whole world on the brink of becoming completely bankrupt?

Why are all the countries in debt? It is quite simple: in the present system, all money is created, comes into being, as a debt.

To understand this, let us divide the economic system into two parts: the producing system and the financial system. The example is taken from Louis Even's parable, The Money Myth Exploded: On the one side, there are five shipwrecked people on an island, who produce all the necessities of life, and on the other side, a banker, who lends them money. To simplify this example, let us say there is only one borrower on behalf of the community; we'll call him Paul.

Paul decides, on behalf of the community, to borrow a certain amount of money from the banker, an amount sufficient for business in the little community, say $100, at 6% interest. At the end of the year, Paul must pay the bank an interest of 6%, that is to say, $6. 100 minus 6 = 94, so there is $94 left in circulation on the island. But the $100-debt remains. The $100-loan is therefore renewed for another year, and another $6 of interest is due at the end of the second year. 94 minus 6, leaves $88 in circulation. If Paul continues to pay $6 in interest each year, by the seventeenth year there will be no more money left in circulation on the island. But the debt will still be $100, and the banker will be authorized to seize all the properties of the island's inhabitants.

Production has increased on the island, but not the money supply. It is not products that the banker wants, but money. The island's inhabitants were making products, but not money. Only the banker has the right to create money. So, it seems that Paul wasn't wise to pay the interest yearly.

$100 debt growth at 6% interest |

||||

| Year | Original borrowed capital | Debt at year end* | Interest due at year end | Money in circulation |

| 1 | $100 | $106.00 | $6.00 | $100 |

| 2 | $100 | $112.35 | $6.36 | $100 |

| 3 | " | $119.10 | $6.74 | " |

| 4 | " | $126.25 | $7.15 | " |

| 5 | " | $133.82 | $7.57 | " |

| 10 | " | $179.08 | $10.14 | " |

| 20 | " | $320.71 | $18.15 | " |

| 30 | " | $574.35 | $32.51 | " |

| 40 | " | $1,028.57 | $58.22 | " |

| 50 | " | $1,842.02 | $104.26 | " |

| 60 | $100 | $3,298.77 | $186.72 | $100 |

| 70 | $100 | $5,907.59 | $334.39 | $100 |

| * includes interest due | ||||

Let us go back to the beginning of our example. At the end of the first year, Paul chooses not to pay the interest, but to borrow it from the banker, thereby increasing the loan principal to $106. “No problem,” says the banker, “the interest on the additional $6 is only 36 cents; it is peanuts in comparison with the $106 loan!” So the debt at the end of the second year is: $106 plus the interest at 6% of $106, $6.36, for a total debt of $112.36 after two years. At the end of the fifth year, the debt is $133.82 and the interest is $7.57. “It is not so bad,” thinks Paul, “the interest has only increased by $1.57 in five years. We can handle that.” But what will the situation be like after 50 years?

The debt increase is moderate in the early years, but the debt increases very fast with time to unbelievably big numbers. And note, the debt increases each year, but the original borrowed principal (amount of money in circulation) always remains the same. At no time can the debt be paid off with the money that exists in circulation, not even at the end of the first year: there is only $100 in circulation, and a debt of $106 remains. And at the end of the fiftieth year, all the money in circulation ($100) won't even pay the interest due on the debt: $104.26.

All money in circulation is a loan and must be returned to the bank, increased with interest. The banker creates money and lends it, but he has the borrower's pledge to bring all this money back, plus other money he did not create. Only the banker can create money: he creates the principal, but not the interest. And he demands to pay him back, in addition to the principal that he created, the interest that he did not create, and that nobody else created either. As it is impossible to pay back money that does not exist, debts accrue. The public debt is made up of money that does not exist, that has never been created, but that governments nevertheless have committed themselves to paying back. An impossible contract, represented by the bankers as a “sacrosanct contract”, to be abided by, even though human beings die because of it.

The sudden increase in the debt after a certain number of years can be explained by the effect of what is called compound interest. Contrary to simple interest, which is paid only on the original borrowed capital, compound interest is paid on both the principal plus the accumulated unpaid interest. Thus, with simple interest, a $100-loan at 6% interest would give, at the end of 5 years, a debt of $100 plus 5 times 6% of $100 ($30.00), for a total debt of $130. But with compound interest, the debt at the end of the fifth year is the sum of the debt of the previous year ($126.35) plus 6% interest of this amount, for a total debt of $133.82.

Putting all these results on a chart, where the horizontal line across the bottom of the chart is marked off in years, and the vertical line is marked off in dollars, and connecting all these points by a line which traces a curve that illustrates the effect of compound interest and the growth of the debt:

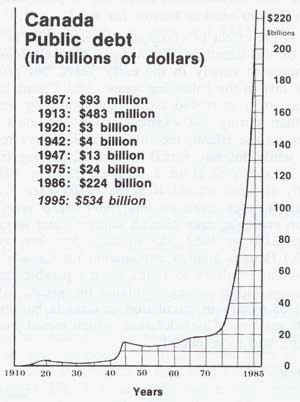

The curve is quite flat at the beginning, but then becomes steeper as time goes on. The debts of all countries follow the same pattern, and are increasing in the same way. Let us study, for example, Canada's public debt.

Each year, the Canadian Government draws up a budget where are estimated the expenditures and the revenues for the year. If the Government takes in more money than it spends, there is a surplus; if it spends more than it takes in, there is a deficit. Thus, for the fiscal year 1985/86 (the Government's fiscal year runs from April 1 to March 31), the Federal Government had expenditures of $105 billion and revenues of $71.2 billion, leaving a deficit of $33.8 billion. This deficit represents a lack in revenues. (The Federal Debt has managed to balance its budget over the recent years, but it is simply because it downloaded its deficit on provinces and municipalities, forcing them to make cuts in health and other basic services. This does not prevent the overall debt of all public administrations to continue to increase.)

The national debt is the total accumulation of all budgetary deficits since Canada came into existence (the Confederation of 1867). Thus, the 1986 deficit of $33.8 billion is added to the debt of 1985, $190.3 billion, for a total debt of $224.1 billion in 1986. (By January, 1994, Canada’s public debt reached the $500-billion mark.)

The national debt is the total accumulation of all budgetary deficits since Canada came into existence (the Confederation of 1867). Thus, the 1986 deficit of $33.8 billion is added to the debt of 1985, $190.3 billion, for a total debt of $224.1 billion in 1986. (By January, 1994, Canada’s public debt reached the $500-billion mark.)

When Canada was founded in 1867 (the union of four provinces — Ontario, Quebec, New Brunswick, and Nova Scotia), the country's debt was $93 million. The first major increase took place during World War I (1914-18), when Canada's public debt went up from $483 million in 1913 to $3 billion in 1920. The second major increase took place during World War II (1939-45), when the debt went up from $4 billion in 1942 to $13 billion in 1947. These two increases may be explained by the fact that the Government had to borrow large sums of money in order to take part in these two wars.

But how can be explained the phenomenal increase of these last years, when the debt almost increased ten times, passing from $24 billion in 1975 to $224 billion in 1986, in peacetime, when Canada had no need to borrow for war?

It is the effect of compound interest, like in the example of the island in The Money Myth Exploded. The debt increases slowly in the early years, but grows extremely fast in the following years. And Canada's public debt has even increased more rapidly during these last years than during the example given in Louis Even's parable: on the island, the interest rate always remained at 6%, while this rate varied in Canada, passing from 2% during World War II to a high of 22% in 1981.

Here is another explanation for Canada’s faster debt growth: contrary to Louis Even's parable, in which the money supply always remains the same, $100, the amount of money in circulation in Canada has increased many times since Confederation, which meant more borrowings... and more debts!

There is a big difference between interest rates of 6%, 10%, or 20%, when one speaks of compound interest. The following are the sums that $1.00 will amount to in 100 years, loaned at the rates of interest mentioned and compounded annually:

at 1%............................$2.75

at 2%..........................$19.25

at 3%........................$340.00

at 10%..................$13,809.00

at 12%............ $1,174,406.00

at 18%............$15,145,207.00

at 24%..........$251,799,494.00

And at 50%, it would eat up the world! There is a formula to know approximately the amount of time it will take for an amount, at compound interest, to double; it is the “Rule of 72”: You divide 72 by the interest rate. It gives you the number of years it will take for the amount to double. Thus, an interest rate of 10% will cause a loan to double in 7.2 years (72 divided by 10).

Another example of compound interest: 1 cent borrowed at 1% compound interest at the birth of Christ would amount (in 1986) to a debt of $3,821,628.40 ($3.8 million). At 2%, it is not only twice this amount that would be owed, but 314 million times this amount: 1.2 followed by 15 zeros (one billion millions of dollars!)

All this is to show that any interest asked on money created out of nothing, even at a rate of 1%, is usury. In his November 1993 report, Canada's Auditor General calculated that of the $423 billion in net debt accumulated from Confederation to 1992, only $37 billion went to make up the shortfall in program spending. The remaining $386 billion covered what it has cost to borrow that $37 billion. In other words, 91% of the debt consisted of interest charges, the Government having spent only $37 billion (8.75% of the debt) for actual goods and services.)

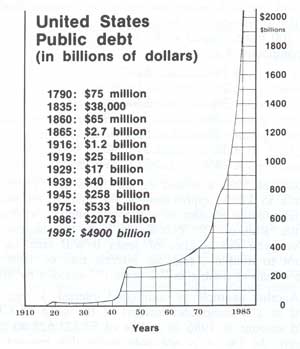

The public debt of the United States follows the same curve as Canada’s, but with figures ten times bigger.

The public debt of the United States follows the same curve as Canada’s, but with figures ten times bigger.

As was the case with Canada, the first significant increases in the public debt took place during war times: the American Civil War (1861-1865), World Wars I and II. From 1975 to 1986, the debt went up from $533 billion to $2,125 billion. (In 2004, this debt is over $7 trillion.) Therefore, during the same period (1975-1986), Canada’s public debt increased more rapidly than the United States’ (9.3 times in Canada in comparison with 3.8 times in the United States). The reason: interest rates were higher in Canada during the same period, reaching as high as a 3-point difference.

When one speaks of millions and billions of dollars, one is talking about very huge sums, and it is quite difficult to figure out what a billion is. A few years ago this definition was circulated: A billion seconds ago, the first atomic bomb had not yet exploded. A billion minutes ago, Christ was still on earth. Spending a billion dollars at a rate of $100 a minute would take 19 years.

But when one speaks of the public debt of the United States, it is not a question of billions, but of thousands of billions, or trillions (1 followed by 12 zeros). In 1986, the public debt of the U.S.A. was $2 trillion. 2 trillion $1 bills placed end to end would stretch 186 million miles – from the earth to sun and back. A 2-trillion dollar spending spree – at a rate of $1,900 a minute – would last 2000 years. In 1981, when the nation’s debt approached $1 trillion, President Reagan illustrated that figure with this example: “If you had a stack of $1,000 bills in your hands only 4 inches high, you would be a millionaire. A trillion dollars would be a stack of $1,000 bills 67 miles high.”

With the debt of the Canadian Government, one must also consider the debt of the Provinces, over $250 billion. And if the debts of governments represent huge sums, they are only the peak of the iceberg: If there are public debts, there are also private debts! The Federal Government is the biggest single borrower, but not the only borrower in the country: there are also individuals and companies. In the United States, in 1992, the public debt was $4 trillion, and the total debt $16 trillion, with an existing money supply of only $950 billion. In 1994, Canada's total debt was $2.8 billion, divided as follows: 18% Federal Government, 13% Provincial and Municipal Governments, 10% Residential Mortgages, 55% Corporations, and 4% Consumer Credit.

The cost of servicing the public debt increases proportionally to the debt, since it is a percentage of this same debt. In 1995, Canada paid $49 billion in interest on the public debt, that is to say, one-third of the total revenues. To finance its debt, the Federal Government sells Treasury Bills and other bonds, most of them being bought by chartered banks.

As regards the sale of Treasury bonds, the Government is a stupid seller: it does not sell its bonds to the banks; it gives these bonds away to them, since these bonds cost the banks nothing: the banks do not lend the money; they create it. Not only do banks get something for nothing, but they also get interest on it.

On September 30, 1941, a revealing exchange took place between Mr. Wright Patman (left), Chairman of the U.S. House of Representatives Banking and Currency Committee, and Mr. Marriner Eccles (right), Chairman of the Federal Reserve Board (the central bank of the U.S.A.) concerning a $2 billion monetary issue which the Bank created:

On September 30, 1941, a revealing exchange took place between Mr. Wright Patman (left), Chairman of the U.S. House of Representatives Banking and Currency Committee, and Mr. Marriner Eccles (right), Chairman of the Federal Reserve Board (the central bank of the U.S.A.) concerning a $2 billion monetary issue which the Bank created:

Mr. Patman: “How did you get the money to buy those $2 billion of Government securities?”

Mr. Eccles: “We created it.”

Mr. Patman: “Out of what?”

Mr. Eccles: “Out of the right to issue money, credit.”

Mr. Patman: “And there is nothing behind it, except the Government's credit?”

Mr. Eccles: “We have the Government bonds.”

Mr. Patman: “That's right, the Government's credit.”

This puts us on the right track for a solution to the debt problem: if these bonds are based on the Government's credit, why would the Government have to go through the banks to use its own credit?

It is not the banker who gives value to money, but the credit of the Government, of society. The only thing the banker does in this transaction is to make an entry in a ledger, writing figures which allow the country to make use of its own production capacity, its own wealth.

Money is nothing else but that: a figure — a figure which is a claim on products. Money is only a symbol, a creation of the law, according to Aristotle's words. Money is not wealth, but the symbol that gives rights to wealth. Without products, money is worthless. So, why pay for figures? Why pay for something which costs nothing to make?

And since this money is based on the production capacity of society, this money also belongs to society. Then, why should society pay the bankers for the use of its own money? Why pay for the use of our own goods? Why doesn't the Government issue its own money directly, without going through the banks?

Even the first Governor of the Bank of Canada admitted that the Federal Government had the right to issue its own money. Graham Towers, who was Governor of the Bank from 1935 to 1951, was asked the following question, before the Canadian Committee on Banking and Commerce, in the spring of 1939:

Question: “Will you tell me why a government with the power to create money should give that power away to a private monopoly and then borrow that which parliament can create itself, back at interest, to the point of national bankruptcy?”

Towers’ answer: “Now, if parliament wants to change the form of operating the banking system, that is certainly within the power of parliament.”

“Yes, but money created by the Government will bring on inflation!” the economists will hasten to say.

Inflation occurs only if there is more money than products. This is what happened for example in 1923 with the German mark (an example economists are found of quoting, to prove that government-issued money would create inflation). The German Government was perfectly aware of the fact that there was more money in circulation than products, and that was to cause inflation, but it continued to print money just the same. This was false accounting, and it is not at all what Social Credit is advocating.

When Social Credit talks of money created by the Government, it does not mean that money can be issued anyhow, according to the whims of the men in office; it means that the State (through an independent organism, which could very well be the Bank of Canada), would deal with the volume of money as an accountant in charge of keeping an accurate record of the total production of the country, expressing production in assets, and consumption in liabilities. In other words, this organism would keep a balance, a constant relation between money and products; this ratio always remaining the same, money would always have the same value, and inflation would be impossible. Having as much money available as there are products is the golden rule to avoid inflation.

And since money is only a matter of accounting, this result would be very easy to obtain: one has only to adjust figures to the production level. There is no need for Government controls on production to reach this objective; the Government has to act only in accordance with the statistics on production: to create money at the same rate as production, and remove this money from circulation at the same rate as consumption. The accountant is not the owner of the money he counts; he is only a bookkeeper. He does not create the facts; he records them; therefore the State would not interfere in the citizens’ choices, or in what producers make or do not make, or in what consumers choose or reject.

In itself, the money issued by the Government is no more inflationary than the money created by the banks, since it is the same money, guaranteed by the same Government, and based on the same production capacity of the country to respond to the needs of the same citizens of the country. On the contrary, money created as a debt by the banks is precisely the first cause of inflation: inflation means prices that are going up. Now, the obligation for companies and governments that are borrowing to bring back to the bank more money than what the bank created, forces companies to inflate their prices, and governments to inflate their taxes.

Inflation also means having more money than products. But in the mind of “orthodox” economists, inflation means “too much money” – period! (They forget to add: “in relation to products”.) Are there many people who complain about having too much money? But these economists try to fight inflation by raising interest rates, which is causing prices to rise… and inflation to rise! As many Canadian Premiers put it, “it is like trying to extinguish a fire by pouring gasoline over it.”

If one admits that the creation of money is possible for a lower authority (the banks), why would it not be possible for the sovereign authority of the country — the Government? What prevents, who forbids the Government to do so? One accepts that banks can create money, but one refuses this power to the Government. The Government refuses to itself a privilege it has granted to the banks: that's the height of imbecility.

Some will object: “But, is it not a good thing for the Government to reduce the deficit? After all, we cannot live beyond our means...”. This may seem logical at first sight, but it actually shows a lack of understanding of the nature and the workings of the money system. When they talk of “living beyond one's means,” they are talking, of course, about the financial means, and not about the physical means: people live on their production, on what exists; they cannot live beyond the physical means, on what does not exist!

What they mean is that society should live in accordance with its financial means, with the money it has. And it is too bad if the financial means do not correspond to production: if there are $100 worth of products and only $50 in cash, one must content oneself with $50 worth of products, and throw away the rest; in other words, to lower the standard of living of the citizens to the financial means. Instead of subjecting the symbols (figures) to reality (the products), it is reality that is subjected to the symbols. The healthy system (production) is brought down to the level of the unsound system (finance).

Governments thus reason: “We cannot spend more than we collect in taxes; we must balance our budget, eliminate the deficit, and this will automatically bring back prosperity!” Well, such a recipe, if applied to the letter, won't bring about prosperity, but disaster: to reduce the deficit to zero in the present system means cutting expenses or raising taxes (or both), which will bring about a drastic decrease in the money supply.

Under the present debt-money system, if the debt were to be paid off to the bankers, there would be no money left in circulation, creating a depression infinitely worse than any of the past. Let us quote again the exchange between Messrs. Patman and Eccles before the House Banking and Currency Committee, on September 30, 1941:

Mr. Patman: “You have made the statement that people should get out of debt instead of spending their money. You recall the statement, I presume?”

Mr. Eccles: “That was in connection with installment credit.”

Mr. Patman: “Do you believe that people should pay their debts generally when they can?”

Mr. Eccles: “I think it depends a good deal upon the individual; but of course, if there were no debt in our money system...”

Mr. Patman: “That is the point I wanted to ask you about.”

Mr. Eccles: “There wouldn't be any money.”

Mr. Patman: “Suppose everybody paid their debts, would we have any money to do business on?”

Mr. Eccles: “That is correct.”

Mr. Patman: “In other words, our system is based entirely on debt.”

How can we ever hope to get out of debt when all the money to pay off the debt is created by creating a debt? Balancing the budget is an absurd straight jacket. What must be balanced is the capacity to pay, in accordance with the capacity to produce, and not in accordance with the capacity to tax. Since it is the capacity to produce that is the reality, it is the capacity to pay that must be modeled on the capacity to produce, to make financially possible what is physically feasible.

Paying off one's debt is simple justice if this debt is just. But if it is not the case, paying this debt would be an act of weakness. As regards the public debt, justice is making no debts at all, while developing the country. First, let us stop building new debts. For the existing debt, the only bonds to be acknowledged would be those of the savers; they who do not have the power to create money. The debt would thus be reduced year after year, as bonds come to maturity.

The Government would honour in full only the debts which, at their origins, represented a real expense on the part of the creditor: the bonds purchased by individuals, and not the bonds purchased with the money created by the banker, which are fictitious debts, created by the stroke of a pen. As regards Third-World countries' debts, they are essentially owed to banks, which created all the money loaned to these countries. These same countries would therefore have no interest charges to pay back, and their debts would be, virtually, written off. Banks would lose nothing, since it is they that had created this money, which did not exist before.

| Previous chapter - Interest on Newly-Created Money Is Robbery | Next chapter - The Labour Question |